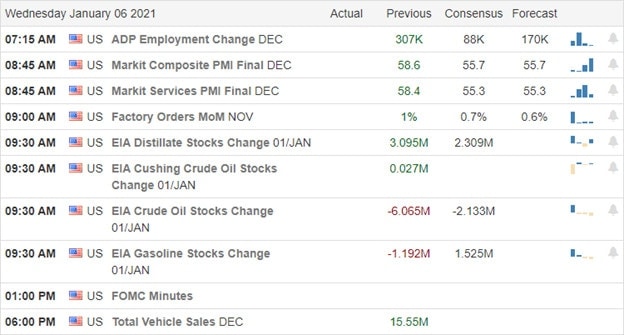

Political news out of the Georgia runoff election and the Congressional vote to certify the Biden presidency with efforts to block the process could set off price action fireworks in the market today. The bulls have defended support levels, but they fell just short of clearing the price resistance above at the close yesterday. With the VIX remaining elevated, be prepared for some news related price volatility, and don’t forget the FOMC minutes’ release this afternoon.

Overnight Asian markets closed mixed but mostly higher as energy stocks surged following the OPEC action. European markets see green across the board this morning, while the U.S. Futures offer up a mixed bag of results with the Dow higher and the other indexes modestly lower heading into the open. Stay focused and flexible as anything is possible on this very political new driven day.

Economic Calendar

Earnings Calendar

On the Hump Day earnings calendar, we have nine verified reports. Before the bell, we will hear from GBX, MSM, RPM, SMPL, & UNF. After the bell, LNDC, RELL, RGP, & SAR will report.

News & Technicals’

We face an interesting day in the market with a lot of political news that has the potential to move the market. First, we have the runoff elections that are drawing closer to flip the Senate raising concerns it will clear the deck for higher taxes. We also Congress try to certify the Biden election win, but a group also moves to block the effort, and protests have already begun. The 10-year Treasury yield rose above 1% for the first time since March in reaction to current Georgia runoff results, and Bitcoin surged above $35,000 for the first time. While politics preoccupy the market, the daily death toll hit new records as more than 3800 Americans succumb to the virus. Sadly, a grisly reminder we may have a long way to go to win this pandemic battle.

Yesterday’s bullish price action lifted the index charts just enough to challenge price resistance but failed to clear the level by the close. We should plan for the possibility of price volatility based on the political wrangling in Congress and Georgia. We also have some economic news to keep an eye on, such as releasing the FOMC minutes at 2:00 PM Eastern to create some price action fireworks. The VIX remains elevated as we attempt to rally, and the Absolute Breadth Index continues to show a concerning decline. Stay with the bullish trend but stay on your toes should the sentiment quickly shift.

Trade Wisely,

Doug

Comments are closed.