The bulls and bears stood toe to toe yesterday, duking it out with either side unable to gain any momentum as we wait on Congress. Evidence continues to show that pandemic restrictions are slowing the economy, and with infection rates exploding to about 1 million every 4-days, I suspect that will only get worse. Has this rally already priced in the stimulus bill? Maybe, so be careful overtrading and consider your risk carefully heading into the weekend and the holiday week ahead.

Asian markets closed the week red across the board in reaction to the Bank of Japan rate decision. European markets this morning show modest gains even as a no-deal Brexit weighs on investor minds. U.S. Futures are trying to shake off overnight lows during the morning pump up that has become all too familiar of late. With a light earnings and economic calendar day, expect an extra dose of news sensitivity as we head into the weekend.

Economic Calendar

Earnings Calendar

We have a light day on the Friday earnings calendar, but we still have a few meaningful reports. Notable reports include APOG, DRI, NKE, & WGO.

News & Technicals’

With an afternoon vote, the FDA endorses the second vaccine choice, with Moderna gains approval for emergency use. A good thing as the infection rate explodes around the country, adding about 1 Million new positive tets in just 4-days. According to reports, the widespread hack included a breach at Microsoft. They are not suggesting millions of Americans may have been affected by the attack. The deadline for a Brexit trade deal is drawing near with several key disputes yet to resolve. A no-deal Brexit could create some stock market and currency market fluctuations. Keep an eye on this developing story.

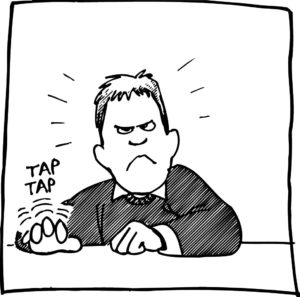

After gapping higher on high hopes of a stimulus bill, the market seemed to lose momentum quickly and chopped in a narrow range the rest of the day. The Absolute Market Breadth Indicator continues to decline, and the T2122 indicator suggests a very extended condition in the indexes. That said, the bears don’t appear to have any teeth, and the trends remain bullish as we wait for a congressional decision. The indexes appear pensive and wound pretty tight, waiting on a news event that can create an explosive move in either direction. As you plan your risk into this weekend, keep in mind volume tends to decline quite sharply, heading into the Christmas holiday shutdown.

Trade Wisely,

Doug

Comments are closed.