Hopes of a vaccine spurred recovery as infection and death rates surge across the country, creating a challenging price action tug-of-war between the bulls and bears. Indexes remain in bullish trends, but the bearish engulfing candle patterns left behind in yesterday’s news-driven whipsaw raise considerable uncertainty. On the one hand, traders don’t want to miss out on a recovery rally, while on the other hand, the risk to price support and key moving averages is considerable. Adept day-traders seem to have the upper hand in this environment as each news report can quickly shift sentiment.

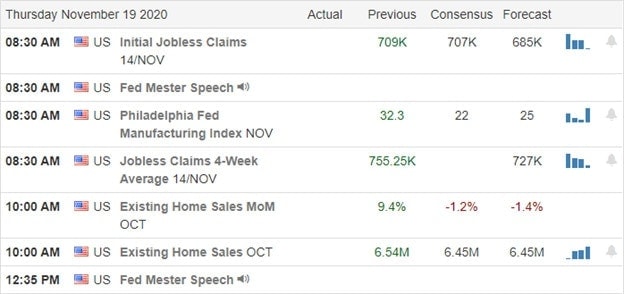

Asian markets traded mixed but mostly lower overnight in reaction to the U.S. selloff. European markets are moving lower across the board this morning. The U.S. futures currently suggest a modestly bearish open ahead of Jobless Claim, Philly Fed MFG., and Existing-Home Sales numbers. Toss in earnings reports, vaccine and shutdown news, and anything is possible by the open.

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have just over 50 companies reporting quarterly results. Notable reports include BJ, CSIQ, INTU, M, NTES, OPRA, POST, QIWI, ROST, WSM, & WDAY.

News & Technicals’

The bulls tried hard to break above the high of the big gap candle, but concerning pandemic, news energized the bears during the afternoon session reversing the early bullishness. With more than 170,000 new infections reported yesterday and the U.S. death toll topping 250,000, the concern is understandable. New York and Boston announced yesterday they schools will go back into shutdown as states across the nation impose restrictions in an effort the combat this invisible enemy. All the deficit spending to keep the economy going has pushed the global debt to new record levels. According to the IIF, the global debt will reach 277 trillion by year-end, and among advanced nations, debt has surged above 432% of GDP. I suspect the massive deficit spending is far from over, with the pandemic surging into the winter months. After the bell yesterday, NVDA reported better than expected results, but the stock moved lower after the CEO guided lower in the coming quarters.

With good vaccine news simultaneously as rising infections, there is a challenging tug-of-war amongst the bulls and bears. In this news-driven environment, day traders seem to have the upper hand while swing traders find it difficult dealing with the wild overnight reversals. During such uncertain price action, trader’s accounts can and will get chopped to pieces if you overtrade in this environment. Technically speaking, the indexes remain in bullish trends, but the bearish engulfing candles left behind yesterday and substantial distance to price support levels will require a substantial tolerance to risk. Of course, another approach is to remember that cash is a position that protects your capital should you deem the risk too high.

Trade Wisley,

Doug

Comments are closed.