A historic market gap on a piece of hopeful vaccine news making new record highs in the DIA and SPY as recovery sentiment surged. Unfortunately, after the pop, profit-takers left behind a negative candle pattern raising the possibility of price pulling back to fill the massive gap. Big tech seemed to struggle while small-caps enjoyed a solid performance as traders looked for value and small businesses to begin recovering. With a very news-driven market and massive price fluctuations possible in the next story, plan your risk very carefully.

Asian markets traded mixed but mostly higher overnight, led by Hong Kong that surged more than 1%. European markets trade green across the board this morning in a choppy session as they grapple with the contradictions of shutdowns and hopeful virus news. U.S. futures have recovered from overnight lows; however, they still suggest a mixed open ahead of earnings and a very light economic calendar.

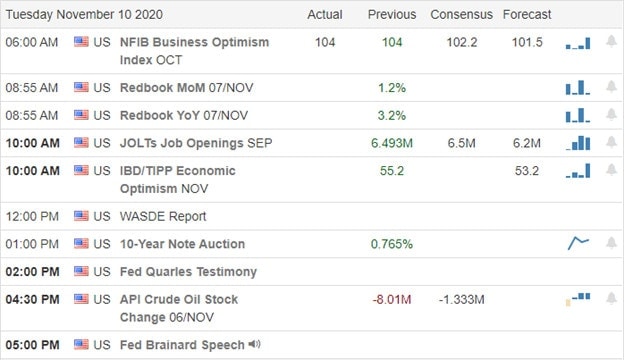

Economic Calendar

Earnings Calendar

We have more than 70 companies reporting 4th quarter results today. Notable reports include AAP, DOX, BRKS, DHI, DDOG, FUBO, LYFT, RXT, RKT,& ROK.

News & Technicals’

As virus numbers continue to rise across the country, there have been several stories about hopeful vaccines providing market confidence. Joe Biden talks about the possibility of a mandatory national mask policy to combat the virus should he be certified as the President-elect. However, President Trump refuses to concede, and the attorney general has started election investigations, which prevents funds from being made available for a transition team. The so-called Obamacare act faces a Supreme Court challenge today, but a decision is not expected until June. The EU launched antitrust charges against Amazon, suggesting they are distorting competition with online retail markets. AMZN shares are suggesting more than 2% lower this morning.

A day after a historic market gap, futures trade mixed but well off of overnight lows. The big pop and drop price action left behind some negative candle patterns, but they held above price support levels by the end of the day. The QQQ had the weakest performance, with many tech giants struggling to find buyers while the small-cap stocks in the IWM gained favor as vaccine hopes drove recovery sentiment. Oil prices surged about 8%, and the financial sector recovered substantially yesterday while stay at home stocks saw strong bearish attacks. The risk remains high in this very news-driven market, so plan your plan carefully because the next big gap or full reversal could be just one story away.

Trade Wisely,

Doug

Comments are closed.