As we wait on an election decision, the pandemic infection rate surged over 120,000 new cases on Thursday. One has to wonder, with job growth beginning to slow and more than 21 million Americans still requiring unemployment assistance, can this massive rally be sustained? That’s something to ponder as we head into the weekend, and you plan risk forward. With the Dow having gained more than 2200 points since last Friday’s low, a little profit-taking would not be out of the question.

Asian markets closed the week mixed but mostly higher. European markets are trading lower this morning as they continue to monitor the U.S. election uncertainty. U.S futures currently point to lower open, but as earnings results roll in and the Employment Situation number in focus, anything is possible as we slide toward the weekend.

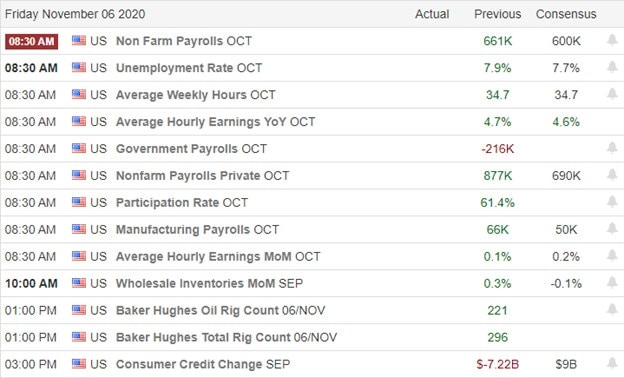

Economic Calendar

Earnings Calendar

On this Friday, we have more than 100 companies stepping up to report. Notable reports include LNG, COTY, CVS, ENS, HSY, HMC, MAR, MYL, TU, TM & VIAC.

News & Technicals’

As counting votes continues to drag, and all the lawyers involved, it feels like we’re waiting on the judge decide who gets custody of us in the divorce. While our focus remains on the election results, the pandemic continues to spread rapidly, with more than 120,000 new cases reported yesterday. Even without government-mandated shutdowns, the concern is growing that business impacts could be severe throughout the winter months. Numbers show that job growth is slowing and more than 21 million Americans still requiring unemployment assistance. According to Moody’s report, the U.S. economy is at a high risk of backtracking due to the surge in pandemic numbers. Whoever wins the election will face the formidable challenge of avoiding a double-dip recession.

After rising more than 2200 points from last Friday’s low, the bulls recovered and held the 50-day average, vastly improving the technical picture of all the index charts. That said, the T2122 indicator shows an extreme short-term overbought condition making new long positions very high risk should profit-takers step in to capture gains ahead of the weekend. Currently, futures markets point to a lower open, but as earrings roll in and markets wait on the Employment Situation number, anything is possible.

Trade Wisely,

Doug

Comments are closed.