Extraordinary bullishness pushed indexes above their respective 50-day averages yesterday, vastly improving the index charts’ technical picture. However, the extreme price move comes with the significant risk of a dramatic pullback as the pandemic infection rates surge to a new daily record, and hospitalizations reach critical levels in several states. As Italy enters a shutdown, the ECB announced another 150 billion in bond buying, helping boost market around the world this morning.

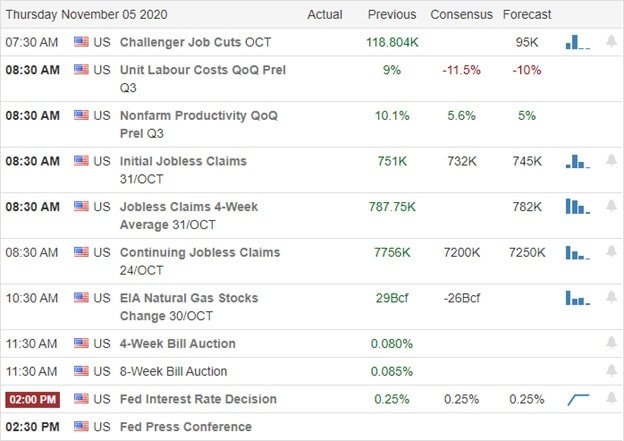

Asian markets surged overnight following the massive Wall Street rally on Wednesday. European markets are green across the board despite the rising economics of more lockdowns going into effect. The U.S. futures are once again flying high this morning ahead of a massive day of earnings reports and an FOMC rate decision at 2 PM Eastern.

Economic Calendar

Earnings Calendar

We have a massive day of earnings reports today, with more than 300 companies confessing quarterly results. Notable reports include DDD, ADT, ALRM, BABA, AMCR, ABC, AINV, MT, ARNC, AZN, BGS, BLL, GOLD, BDX, BKNG, BMY, CZR, CNQ, CAH, CI, CNK, ED, CLR, CUBE, DISCA, D, DBX, DUK, EA, FLO, GM, GLUU, GPRO, GRPN, HLF, HFC, TWNK, HUBS, IAC, IRM, TREE, LSI, LIN, LYV, MAC, MAIN, MLCO, MCHP, MNST, MUR, NYT, NWSA, NLSN, NLOK, PZZA, PK, PTON, PLNT, PBPB, PLL, RMAX, RRGB, RDFN, REG, REGN, ROKU, SRE, SQ, STAG, STMP, STOR, SWTH, TMUS, TTWO, SKT, TRIP, UBER, VER, YELP, YETI, ZG, & ZTS.

News & Technicals’

As they continue to count votes is looking more and more like a Biden win is on the way. Still, some are saying we won’t have a definitive decision with multiple legal challenges until late November or early December. However, it looks as if whoever becomes President, the results in the Senate and House point toward gridlock, which the market appears to like gaging by its wildly bullish response yesterday. While everyone focused on election results, the pandemic infection rates soared to a new daily record of more than 100,000. Hospitalizations also surged at an alarming rate, reaching record levels in Missouri, Oklahoma, Iowa, Indiana, Nebraska, North Dakota, and New Mexico. Iowa and Missouri warned the hospital bed capacity could soon become overwhelmed. Senate Leader Mitch McConnell is now suggesting an urgency to come to a stimulus agreement by the end of the year, boosting futures markets. Also helping to boost market sentiment this morning, the ECB injected another 150 billion in bond buying as Italy enters lockdown.

Yesterday’s market surge was extraordinary as the bulls gapped the four major indexes above their respective 50-day morning averages. In a late-day selloff, the DIA drifted back down below it 50-day while the SPY, QQQ, and IWM held on to this key psychological support. Facing our biggest day of earnings reports so far this quarter as well as an FOMC rate decision, we can expect significant price volatility. With the indexes, so extended traders will have to shoulder the substantial risk of pullback to enter long positions. That said, with hopes of a stimulus deal on the horizon, entering short positions also carries substantial risk. Set aside emotion and plan carefully in this very news-driven market.

Trade Wisley,

Doug

Comments are closed.