The bulls indicate a willingness to fight back this morning, with the market finally bouncing from a short-term oversold condition. That said, anything is possible in the next few days as businesses shut down and board up their building in anticipation of the possible election aftermath. A quick study of the enormous emotional price swings during the 2017 election would suggest whipsaws and full reversals are possible in the coming days. Plan your risk accordingly. Experienced day-traders will likely have the upper hand so expect substantial price volatility over the next few days.

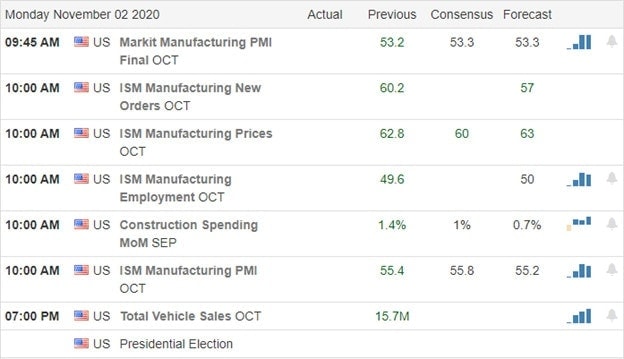

Asian markets closed green across the board last night, with China reporting growth in manufacturing activity. European markets are also bullish this morning despite news of the pandemic related lockdown of England this weekend. Ahead of earnings, PMI and ISM Manufacturing, and construction spending data, the U.S. futures are leaping higher this morning as a relief rally begins.

Economic Calendar

Earnings Calendar

We have nearly 70 companies stepping up to report quarterly results this Monday. Notable reports include AMC, AMCX, AWR, CWH, CDW, CLX, CVI, FANG, EL, FE, FRPT, IR, LEG, LDOS, L, LL, MPC, MDLZ, NI, ON, PYPL, O, SWKS, RIG, VNO, WM, & WMB.

News and Technicals’

After a rough week of selling that tested the DIA 200 and 500-day averages, the bulls are trying to get back to work this morning, pointing to a substantial gap up at the open. We closed last week with the T2122 indicator suggest and extreme oversold condition in the short-term, but we will have to be careful with such a strong bounce on the eve of such a news-driven Presidental election. According to reports, businesses have begun boarding up windows and shutting down, fearing the possibility of riots breaking out based on election results. Over the weekend, England, a countrywide lockdown of all non-essential business as Covid cases continue to rise across the eurozone. The U.S. cases spiked to a record high on Friday, with nearly 100K new infections reported. One has to wonder what kind of policy impacts we might face in the U.S. to combat COVID once the election is over?

With markets currently pointing to a considerable bounce this morning, we should expect the massive price volatility to continue as election and pandemic uncertainty looms. The relief rally could quickly start a short squeeze trader hurry to cover positions held over the weekend to preserve profits. However, with the possibility of politically charged news over the next few days, traders will have to remain very nimble. What for quick intraday whipsaws or even full price reversals that could occur overnight. Just remember the massive price swings in 2017 as the election emotion shifted violently. Adept day traders will have the upper hand, with swing and position traders having little to no edge as the future unfolds.

Trade Wisely,

Doug

Comments are closed.