A political battle royal has begun for the appointment of a Supreme Court Justice, and the aftershocks are creating market havoc this morning with the US Futures pointing to an ugly gap down open. The morning selling will make the lower low to confirm the downtrend in the DIA, SPY & QQQ. There is also significant pressure in the financial sector after leaked documents that show red-flagged transactions that amount to more than $2 trillion. Today could be a very painful day for the buy the dip buyers that loaded up on trades last week. Be careful as fear and possible margin calls could accelerate the selloff.

Asian markets closed mixed but mostly lower after the report that HSBC moved most of the suspicious money flagged in the leaked report. European markets are decidedly bearish this morning, with indexes trading more than 3% lower this morning. US Futures also point to a painful open that will create substantial damage to trader confidence and technical damage in the index charts. Prepare for a wild ride!

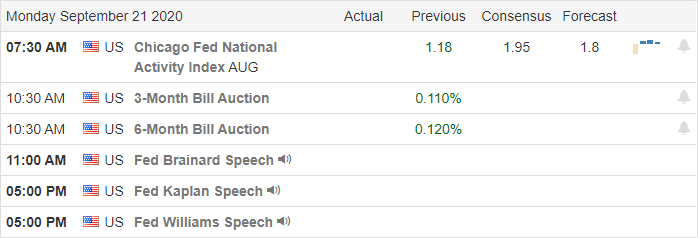

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have 18 companies stepping up to report quarterly results, but there are not any particularly notable.

News & Technicals’

It seems the appointment of a new Supreme court justice will become a distraction political battle royal and possibly pulling attention away from completing an additional stimulus package. It’s such a hot topic that candidates received a record 90 million in campaign contributions as it fired up both political bases. Nancy Pelosi has gone as far as to threaten impeachment proceedings in an attempt to block a Trump appointment. This morning’s futures market sums up the intensity of the distraction, with Dow currently expecting a gap down of more than 500 points. According to reports, the President approved the Tiktok deal, and China has responded, saying they will blacklist some US tech firms raising uncertainty for foreign tech business. Leaked US government documents show that several big banks may have moved elicit funds. Germany’s largest bank, Deutsche Bank, tops the list and appears to have facilitated the more of the $2 trillion in suspicious transactions flagged by the US Government. JP Morgan is second on the list. Both banks indicate lower this morning, putting additional pressure on the markets.

The question of whether the 50-day morning average of the Dow holding as price support has been answered this morning with a punishing gap down at the open. The lower low not confirms the downtrend of the DIA, SPY, and QQQ and creates substantial technical damage in the charts. I would not be at all surprised to hear about margin calls that have the potential to accelerate the selling. Today may prove to be one of those awful market days that test a trader’s tolerance to risk. Buckle up for a wild ride.

Trade Wisely,

Doug

Comments are closed.