The celebration of the FOMC’s commitment to hold rates at historic lows for years lasted about an hour before the bears reemerged, seemly gaining the upper hand by the close. The price action left behind some troubling candle patterns and set the stage for possible index lower highs at price resistance. With futures pointing to a nasty gap down open, the question now is, will recent lows and the 50-day moving averages hold as support?

Asian markets closed in the red across the board overnight. European markets are also decidedly bearish this morning despite the Bank of England’s’ decision to keep rates low. Ahead of potentially market-moving economic reports, US Futures point to a substantial gap down at the open. Expect another wildly volatile day.

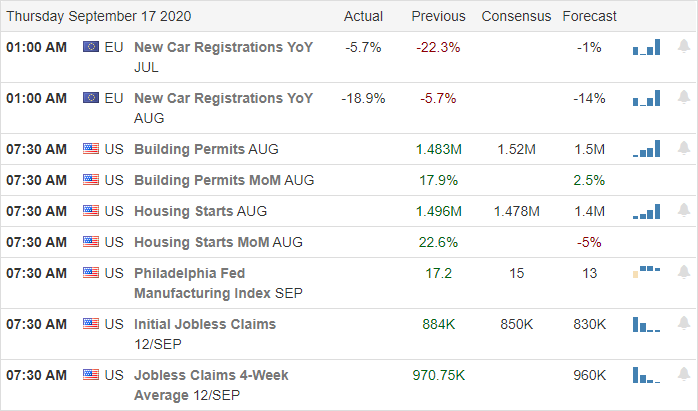

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have a light day with less than 10 confirmed reports. Notable reports include APOG & CMD.

News & Technicals’

After the FOMC committed to keeping interest rates at historic lows, we experienced a nasty intraday reversal with the bears surging into the close. During the Jerome Powells press conference, he noted that the economy looking forward remains uncertain and may take an extended time for employment to recover. Snowflake, ticker (SNOW) doubled yesterday to become the most significant software IPO in market history. The shares priced at $120 per share for the initial offering soared to over $253 in yesterday’s trading. OPEC and its allies are meeting today to discuss production limits. Analysts at this time don’t believe there will further production cuts but do expect the then to renew their commitment to the deep cuts they’ve already made.

The last hour selloff in the indexes left behind some worrisome candle patterns at or very near price resistance levels, possibly setting the stage for lower high price patterns. Early rallies in the financial and oil sectors struggled to hold onto gains as the bears once again seem to gain the upper hand. Unfortunately, the US Futures currently point to a substantial gap down this morning. A painful reminder that buying stocks near price resistance levels is a practice that retail traders should avoid. The question to be answered now is whether the recent lows at or near the 50-day moving averages will hold as price support or will an official downtrend be established? Today we have a light day on the earnings calendar, but before the bell, we will get the latest reading on Housing Starts, Jobless Claims, and the Philly Fed MFG Index. Prepare for another volatile day.

Trade Wisely,

Doug

Comments are closed.