It looks as if yesterday’s nice relief rally will enjoy a flow-through gap up this morning. The question is, will the bears be lying in wait to attack as we approach resistance in the index charts? The lackluster performance of big tech and the new daily record of COVID-19 cases reported by the WHO adds some uncertainty. Remember, the FOMC meeting begins today, and the market will often become choppy as it waits for there direction.

Asian markets closed mostly up overnight as China reported its first positive retail sales report since the beginning of the pandemic. European markets are cautiously bullish this morning as they await the central bank decision. Us Futures point to another substantial gap up open ahead of economic and earnings news and kick off the of the 2-day FOMC meeting.

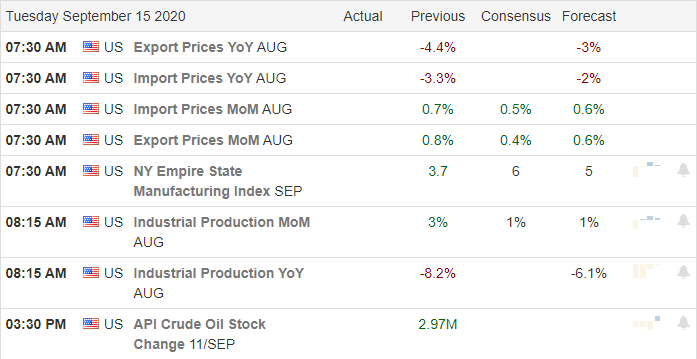

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 17 companies reporting quarterly results. Notable reports include ADBE, FDX, and CBRL.

News & Technical

The nice relief rally fell short of breaking price resistance in the index charts as big tech produced a lackluster performance. The VIX pulled back but remained relatively elevated, closing well above 25 handles. The WHO reported a record one-day spike in coronavirus cases and warned that the pandemic shows few signs of slowing. In a somewhat confirming story of the epidemic, the IEA cut 2020 oil demand seeing a ‘treacherous’ path ahead due to the rising cases heading into the fall. The President seems to have walk back his requirement of a TicTok sale approving of the deal with Oracle. Apparently, in the partnership of the social media app, Oracle will be responsible for the privacy concerns that caused potential banning. However, make no mistake the apps fundamental purpose to data-mine users as all social media will continue.

Technically speaking, yesterday’s bounce quickly moved the T2122 indicator from short-term oversold but may near a short-term overbought condition as soon as the open today as the all or nothing knee-jerk reaction volatility continues. The FOMC meeting begins today, and traders should keep in mind that it’s pretty standard for the market to become quite and the price action choppy as we wait for the statement and Powell’s presser. As we approach resistance in the index charts, observe to see if the bears will line up in defense. Yesterday week performance in the big techs is a bit concerning should those bears decide to attack. With the election on the horizon and coronavirus cases rising, the uncertainty of the path ahead is likely to keep traders on edge and volatility high. Plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.