A new record high in the SP-500 but an intra-day whipsaw and a rising VIX could suggest a little turmoil is brewing under the surface. As we head into a big day of data, the market is hoping to get more clarity and forward guidance on continued aggressive asset purchases from the Jackson Hole symposium. The bulls have enjoyed an incredible run producing the best August for the SP-500 since 1986. Heading into the weekend stay focused and plan your risk carefully yesterday’s turbulence may signal profit-taking could begin at any time.

Asian markets closed mixed but mostly higher overnight after hearing there longer serving Prime Minister will step down citing health concerns. European markets are also mixed but mostly lower this morning as US Futures continue to drive higher with the Dow pointing to a gap up of 100 points but a relatively flat NASDAQ.

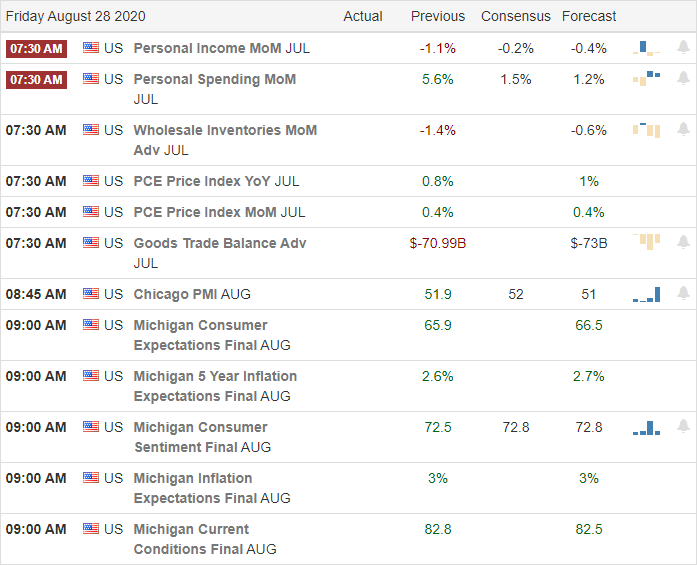

Economic Calendar

Earnings Calendar

The Friday earnings calendar is a relatively light day with just 12 companies reporting. Notable reports include BIG & HIBB.

News & Technical s

The new Fed policy that will allow inflation to rise above 2% by keeping interest rates very low for an extended time was approved by the market with a new record high in the SP-500. However, there was some volatility during the day with an intra-day whipsaw that the bulls managed to defend by the close of the day. With the Jackson Hole symposium continuing today the markets are hoping to hear more forward guidance from the Fed and a commitment to continue aggressive asset purchases. With all the warm a fuzzy talk and massive amounts of newly printed money, the SP-500 is headed for it best August since 1986 despite 1 in 3 unemployed Americans. Interestingly the VIX rallied briefly above 26 handles settling at the close in the mid 24’s, indicating investors remain nervous that another market dip is possible.

The technicals of the daily index charts remain very bullish; however, the intra-day whipsaw, a falling absolute market breadth index, and rising VIX may suggest a little trouble under the surface of this historic recovery rally. With a big day of possible news-driven price action and the weekend just around the corner, plan your risk carefully and don’t be surprised if profit-taking picks up to capture the gains of this very bullish week. Have a wonderful weekend, everyone.

Trade Wisely,

Doug

Comments are closed.