The NASDAQ gap up this morning my well create its 31st record high in the index this year. Fueling the bullish morning sentiment is news that Congress is nearing a deal on another massive spending bill, and the Fed is nearing a commitment to leave interest rates low for years to get an inflation rate above 2%. Yesterday Gold topped $2000 an ounce and is up by another $36 and Silver continue rapidly rising on the devaluing of the US dollar. Buy, Buy, Buy and party like its 1999.

Asian markets closed mixed but mostly higher overnight as tensions grow with a US visit to Taiwan likely to anger China. European markets are in rally mode this morning, reacting to favorable earnings results. US Futures point to another gap up open ahead of a busy day of earnings and economic reports hopeful of a more than trillion-dollar stimulus deal on the way.

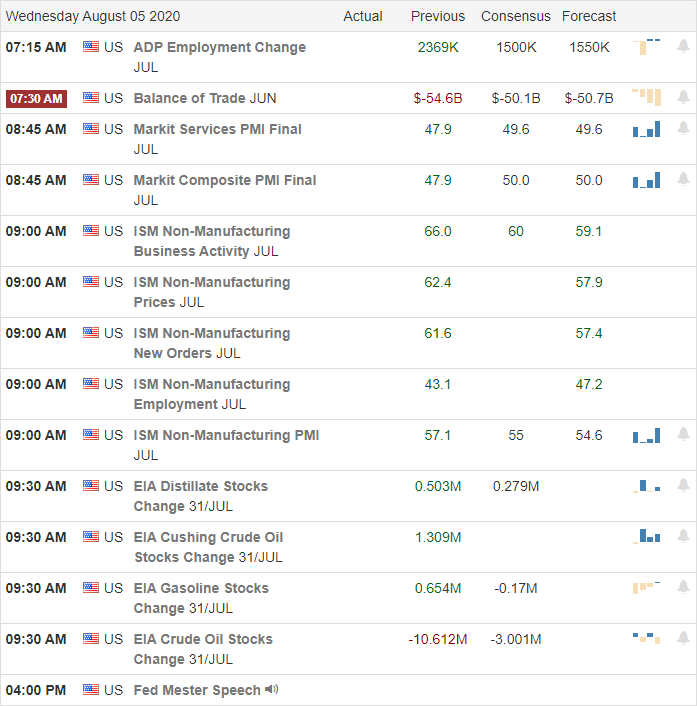

Economic Calendar

Earnings Calendar

On the Hump day earnings calendar, we have more than 300 companies reporting results. Notable reports include FSLY, SQ, DDD, ALRM, ALB, AWK, ABC, BNFT, BWA, BIP, CWH, CNVA, FUN, CTL, CVS, DISCA, ENR, EPR, ETSY, FRT, FISV, FIT, FNV, GDDY, TWNK, HUBS, HUM, IIPR, JCK, LYV, MRO, MET, MRNA , NYT, NLSN, OIH, PAAS, PBPB, PSA, REGN< ROKU, SRE, STOR, SPWR, TRI, VSLR, W, WELL, & WEN.

News and Technical’s

News that Congress may soon reach an agreement on the stimulus bill and the possibility that FOMC may commit to not change interest rates until reaching a 2% inflation rate has today’s futures suggesting more new record highs. The gap up at the open will create the 31st new record high this year in the NASDAQ as unprecedented Fed actions, and government spending programs continue to drive the market higher. Also quickly rising is Gold, which topped $2000 per ounce yesterday and is another $36 per ounce this morning as we continue to devalue the US dollar. A national debit quickly nearing 27 Trillion seems to be of no consequence as long as the market moves higher. Disney reported it lost 3.5 billion in theme park revenue, but with 100 million subscribers to the Disney Plus app, the stock is up more than 6% higher this morning. Today we will hear from ADP on their Employment Report, International Trade, ISM Non-Manufacturing Index, and the Petroleum Status numbers as well as more than 300 earnings reports. F=Remember we are building toward the Employment Situation number Friday morning. Not that unemployment matters anymore in light of all the newly printed money.

Technically speaking, the bulls reaming solidly in control with the tech sector continuing to set new records and the Dow that may well top 27,000 with this mornings gap up. The VIX remains elevated but closed below a 24 handle for the first time since February. Today the DIA 50-day average is likely to cross the 200-day average recovering from the cross down that occurred in mid-March. Follow suit will be the IWM cross that may rise above later this week or early next week, assuming the bears continue to stay away.

Trade Wisely,

Doug

Comments are closed.