Big tech continues to lead the way higher with Congress deadlocked on the next stimulus bill and a sharply declining Absolute Breadth Index. New tensions with China are having a slightly bearish effect on the market this morning as they label the US a ‘Rogue Country’ accusing the US of theft as the government clears the way for MSFT to purchase TikTok. China once again vows retaliation as we head into another big day of earnings reports.

Asian markets saw bullnesss across the board during the night, with Hong Kong rising a full 2%. European markets are mixed but mostly higher but have retreated from session highs on weak earnings results. US Futures point to a modest decline at the open in reaction to China tensions with the latest reading on Factory orders and a slew of earnings reports for the market to digest this morning.

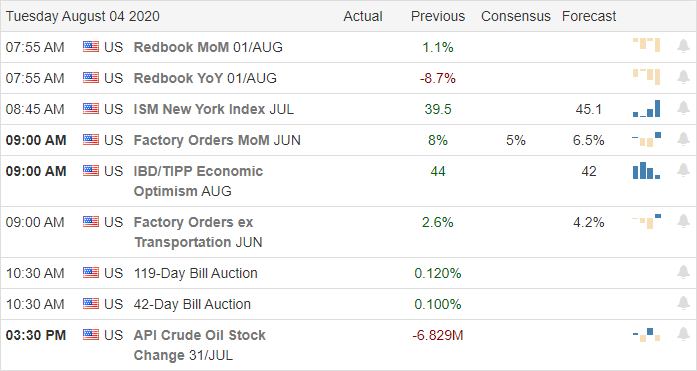

Economic Calendar

Earnings Calendar

Tuesday is a busy day on the economic calendar, with over 200 companies stepping up to reports quarterly reports. Notable reports include BP, DIS, ATVI, ACM, ALL, AMCX, ANDE, ARNC, ANET, BYND, CNK, DVN, EXC, EXPD, EXR, FOXA, IT, GLUU, GDOT, IGT, KRR, LDOS, LC, TREE, LGIH, LPSN, MIC, MNK, MTCH, MCHP, NMST, NKLA, RL, TWLO, WU, WW, & WYNN.

News and Technical’s

It would seem the possible purchase of TikTok by MSFT has inflamed the tensions between the US and China. During the evening, Chinese state media slammed the US as a ‘rogue country.’ They call it a smash and grab of the Chinese technology and vow retaliation. The US has said that the App is a security risk funneling user data directly to the Chinese government, and without the possible purchase from MSFT, the was on the path to be banned by executive order. After another day of negotiations that, according to reports, was productive but ended with no deal on the stimulus thus far. The President is now saying if they don’t get it done soon, he could do by executive order. Morgan Stanley believes the vast sums of money put into keeping people in work as well as supporting those that are unemployed could make the difference in driving up inflation. The sharp rise in Gold and Silver would seem to agree with that sentiment. What that might mean for the future of the economy and its effects on the overall market, only time will tell.

Yesterday the QQQ closed at a new record high with all indexes rising with APPL and MSFT leading the bullish charge. The massive imbalance in the market continues to grow as with just a few tech giants lifting the indexes as the Absolute Breadth Index continues to decline sharply. That said, the technicals of the index charts remain very bullish with the DIA 50-day average posied to cross above its 200-day. As the indexes stretch out to new records on the bullishness in tech Gold, Silver and bonds continue to rise, and VIX remains stubbornly elevated. The question is, how long can this continue and what happens when the next shoe drops? Stay focused, and flexible.

Trade Wisely,

Doug

Comments are closed.