With more Federal stimulus on the way, the bulls continue the drive higher yesterday after news that the Senate may allow a reduced unemployment bonus payment of $100 per week. Today we have our biggest round of earnings this week and will also get the latest reading on unemployment. So far, the market has shrugged off the rising tensions between the US and China though many are warning that impacts could have significant market impacts. For now, the bulls are large and in charge, with no signs of slowing down in the charts.

Asian markets closed mixed but mostly lower overnight as US/China tensions grow. However, European markets are decidedly bullish, seeing green across the board. US Futures point to another gap up open focused on more stimulus, earnings reports.

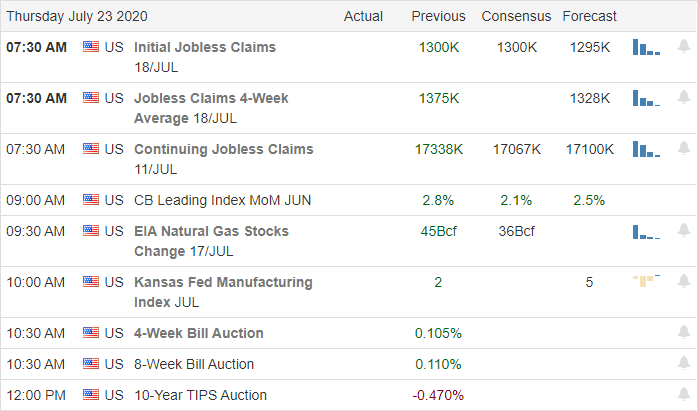

Economic Calendar

Earnings Calendar

Today we have our biggest day of earnings this week with 110 companies reporting. Notable reports include APD, ALK, AB, T, AN, BX, SAM, CTAS, CTXS, DHR, DWO, EW, EXPE, FCX, HSY, HBAN, INTC, KMB, MTB, MAT, NUE, PNR, PBCT, PHM, SWKS, LUV, TSCO, TRV, TWTR, UNP, VRSN, & GWW.

News and Technical’s

Focused on hopeful earnings reports, the indexes continued the rally with a strong late-day surge. The bulls shrugged off rising tensions between the US, and China and the markets remain unconcerned about the protest violence around the country and or the rising pandemic death toll. After the bell, yesterday MSFT reported as expected but sold off about 2%, and TSLA reported is 4th straight profit seeing a rally in aftermarket trading. The Senate reportedly reached a tentative $1 trillion agreement on the next round of federal stimulus. We are still waiting on the retaliation that Beijing has vowed on the closure of the Houston consulate. Some have started to mention the tensions as the next cold war and concerns are growing as to far the two countries will go and how deep the possible market impacts could become in the near future.

Technically speaking, the indexes are in bullish patterns, and the bulls are pushing yet another gap up open this morning. Today we have our biggest day of earnings this week and will get the latest reading on unemployment which is expecting about 1.3 million new filings. About 20 million Americans remain unemployed, which is far higher than during the depths of the 2008 financial crisis. It would seem as long as the central banks and government stimulus continues to deficit spend employment is no longer a factor considered for economic health. I suspect we can expect more of the same as the presidential election nears. Buckle up for a bumpy ride.

Trade Wisely,

Doug

Comments are closed.