With markets around the world surging under bull pressure while at the same time coronavirus infection rates set new records, one has to wonder if the rally is real or if the world is suffering from a major case of denial? I guess we will find out if companies can support these prices with 3rd quarter earnings just around the corner. Set for a big gap up open, the indexes will be testing key moving averages resistance levels as well as the island reversal patterns created in early June. The question for today, will we see follow-through buying after the gap, or will it produce another pop and drop pattern like Friday?

Asian markets closed sharply higher overnight, with the Shanghai index leaping nearly 5.75%. European markets are very bullish this morning with the DAX, FTSE, & CAC all higher by more than 1.5%. US Futures point to a substantial gap up at the open as the bulls push once again push for new record highs in the tech sector.

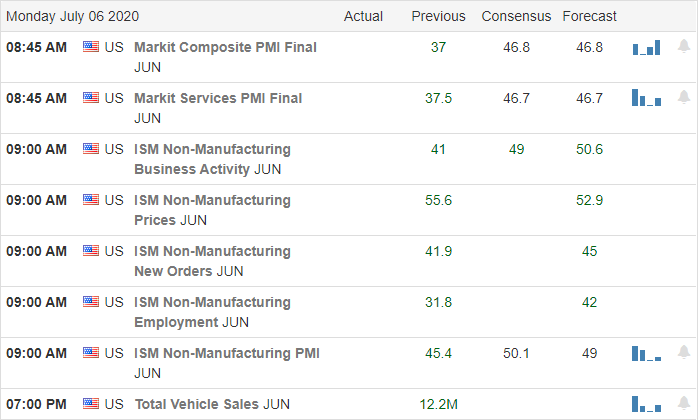

Economic Calendar

Earnings Calendar

On Monday’s earnings calendar, we have 35 companies stepping up to report quarterly results. However, looking through the list, I’m not finding any of today’s reports as particularly notable.

News and Technical’s

After a holiday, 3-day weekend markets around the world surge higher. With 3rd quarter earnings only a couple weeks away, there seems to be no price too high as market leaders set new records. I can’t decide if this rally is justified or if the entire world is suffering from a major case of denial. Over the weekend, health departments reported increased infection rates in 40-State with some Texas regions reaching their hospital capacity. Florida reported more than 10,000 new infections each day of the long weekend. Lawlessness is also on the rise with more 40 shootings in New York alone that resulted in an 8-year old innocent bystander killed by a stray bullet. Although 1.4 million people filed for unemployment last week, the Employment situation number better than expected rehiring occurred over the previous month. With unemployment, at 11%, the market appears to ultra-confident that the coming earnings season will support current stock prices.

With the market set to open with a huge gap up open, the DIA and IWM will once again attempt to break above their 200-day averages. The QQQ will challenge new record highs, and the SPY will test the resistance fo the island reversal pattern printed in early June. I expect T2122 to reach into the bearish reversal zone at the open, so be careful chasing the open with a fear of missing out. Please make sure there are follow-through buyers rather than the pop and drop pattern like we saw on Friday’s morning gap.

Trade Wisely,

Doug

Comments are closed.