The market continued its roller-coaster ride of wild volatility, rising sharply in hopes of more government stimulus on the way as the coronavirus spread to more than 44,000 people yesterday. Several states have once again closed bars and fitness facilities as the WHO warns that the worst is yet to come in the world war against the pandemic. Overnight China defiantly passes the so-called national security law for Hong Kong and threatened retaliation for any actions brought against them. What that means in the weeks and months ahead is anyone’s guess.

Asian markets rallied overnight as their June PMI beat expectations. European markets trade mixed in a whipsaw session as they react to Chinese data and the WHO pandemic warning. US Futures appear to be struggling for the inspiration to follow-through yesterday’s bullishness pointing to a flat open ahead of a big day of Fed speak that includes Jerome Powell.

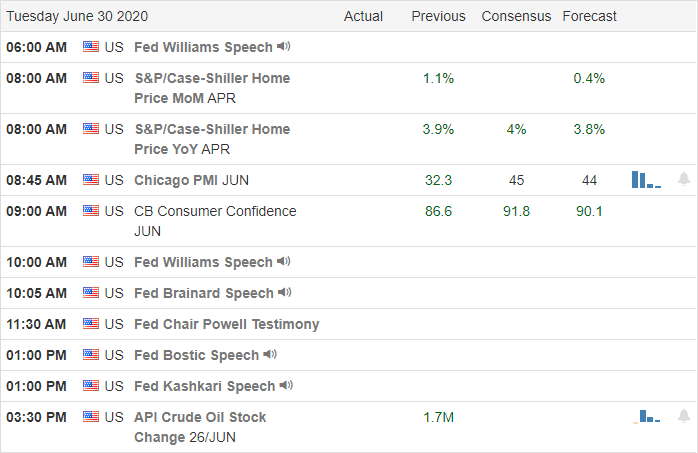

Economic Calendar

Earnings Calendar

On the Tuesday Earnings Calendar, we have just 15 companies stepping up to report on this last day of the 2nd quarter. Notable reports include FDX, AYI, CAG & SCS.

Technically Speaking

The market overlooked rising coronavirus and rallied sharply, mainly on the hope there will be more governmental stimulus on the way. Yesterday, we saw an increase of 44,734 new cases of the virus reported in the US. According to the reports, China has discovered a new strain of the coronavirus, and the WHO warns the worst is yet to come. Shell has announced that it will take a massive write-down up to 22 billion as a result of COVID impacts on the industry. Wells Fargo said it would cut dividends after the Fed stress tests, but JPMorgan, Citi, and Goldman stated they would matain dividends in the coming quarter. During the night, China passed what they called a Hong Kong national security law for Hong Kong that has drawn criticism from around the world. When asked about possible repercussions, Chinese officials defiantly stated they would retaliate against any actions or sanctions brought against them. Boeing had its first successful test flight of the 737 Max yesterday as they pursue recertification of the aircraft after the deadly crashes that grounded them more than a year ago.

Although the Dow rose 580 points by the close yesterday holding on to its 50-day average, the index continues to remain in a short-term downtrend. The SPY printed and Piercing Candle Pattern holding its 200-day average while the IWM did much better breaking the high of Friday’s big selloff. As wonderful as that may seem on the surface, the SPY and IWM technically remain in short-term downtrends with the Absolute Breadth Index pulling back yesterday. A big part of yesterday’s rally likely was nothing more than short-covering. On the last trading day of the quarter, anything is possible, but as of now, the futures seem to be struggling for the inspiration to follow-through on the bullishness for a second day, suggesting a flat open.

Trade Wisely,

Doug

Comments are closed.