After a lackluster day of price action heading into a quadruple witching Friday, the bulls say we don’t care about record increases in COVID infections and unemployment higher than expected. With this morning’s gap up, the DIA and IWM will test their 200-day averages as resistance, and the QQQ may reach out for another record high. That said, the VIX remains elevated, suggesting as we head into the weekend, the likelihood of high price volatility remains quite high.

Asian markets close the week on a positive note seeing green across the board. European markets are also trading in the green this morning across the board. US Futures points to a gap up open of more than 200 Dow points, and the Nasdaq will be very near all-time highs at the open. Keep the fear of missing out in check this morning as we pop into resistance highs at the open. Watch price action to see if there will be follow-through buying after the gap.

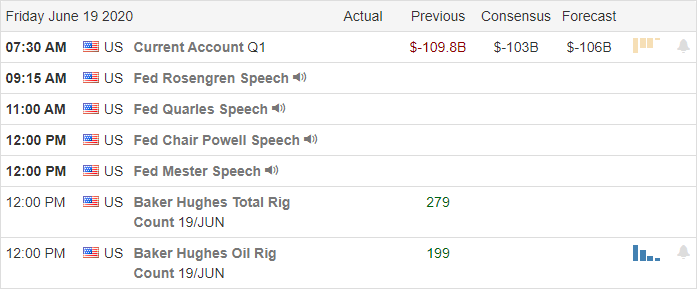

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have a very light day with just 10 companies reporting quarterly results. Notable reports include KMX & JBL.

Technically Speaking

Yesterday was a very lackluster day in the market after jobless claims came in higher than expected, but the bulls quickly absorbed any selling as the QQQ eked out the 5th straight day of gains. The DIA & IWM closed marginally lower with both below their respective 200-day averages. In a last-minute push by the bulls, the SPY that languished in the red all day closed up by 12 cents. Covid-19 infections hit record numbers in a few states yesterday. California, in reaction to the rapidly climbing numbers, now requires masks in all indoor spaces, and the CDC has raised death toll estimates in the US to more than 200,000. Royal Caribian cures lines reported losing 4 billion dollars last quarter and are looking to raise money to hold on by considering the sale of ships. Norigean cruise lines have suspended all sailings until September.

This morning the bulls suggest they don’t care about rising infection rates and higher than expected unemployment pushing for a gap up open on the quadruple witching day. That said, the VIX remains quite elevated closing just below a 33 handle suggesting there is a fear of the uncertainty, but for now, the bulls seem to have an unlimited capacity to ignore. At the open, the DIA and IWM will once again test their 200-day averages as resistance as the QQQ will aim for a new record high. Expect price volatility to remain high and be careful, chasing the morning gap that is so near index price resistance levels as we head into the weekend.

Trade Wisely,

Doug

Comments are closed.