Today the market has a lot to digest on the economic calendar with the FOMC announcement and the follow Powell press conference. The bulls and bears seesawed back and forth in the overnight session and seem to be setting up for a cautious open as we wait for the Fed. Choppy light volume price action is not uncommon ahead of the announcement, but after anything is possible.

Asian markets closed mixed but mostly modestly lower as inflation data missed expectations. European markets are slightly smaller across the board this morning as they wait on the US Central Bank decision. US Futures point to a relatively flat open with Mortgage Applications spiking 13%, earnings reports, and several potential market-moving reports.

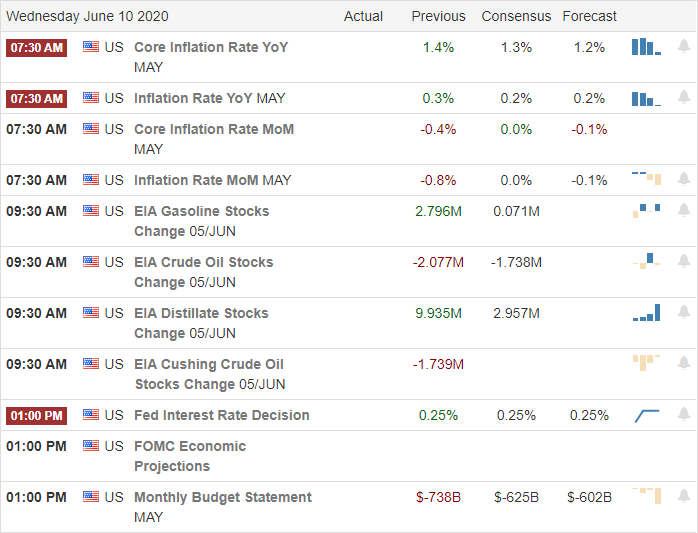

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have 36 companies reporting quarterly results. Notable reports include CHS, DAKT, GES, & RRGB.

Technically Speaking

A mixed set of results yesterday as the Dow broke a 7-day winning streak but he NASDAQ reached out to 10,000 for the first time in history. Big international tech led the way higher with very few other companies finding the energy to move. With giants such as AMZN, AAPL, GOOG, FB, and MSFT weighted so heavily in three out of the four major indexes, we no longer have an accurate reflection of what the majority of the stocks are doing. On the virus front, California is reporting hospitalizations are going up again just one day after Texas hit a new record high of COVID-19 admissions. Dr. Fauci, the White House health advisor, said on Tuesday that the pandemic in the US is not over. Let’s hope this is not a new trend because another round of restrictions could prove devastating to businesses trying to recover.

Today the market will have plenty of economic data to digest with reports on CPI, Petroleum Status, and of course, the FOMC decision with the Chairman press conference. Futures seesawed in the overnight session currently pointing to a flat open as we wait for Jerome Powell to deliver the committee insights into the economy. It’s relatively common to have light choppy, low volume price action ahead of the announcement, and anything is possible after the fact as the market reacts. The T2122 indicator continues to suggest an enormously extended market condition, but trillions of dollars pumped into the markets the bears seem to have lost their teeth. However, we should always keep an eye on price action because a profit-taking pullback could begin at any time.

Trade Wisely,

Doug

Comments are closed.