The bullish optimism was on display yesterday as the Dow surged more than 500 points to challenge its 200-day moving average, and the NASDAQ reached out to test all-time highs. After several days of the strong rally, it is, however, not a big surprise to see the future gaping slightly lower as under the pressure of some profit-taking. Unemployment will be the theme for the next couple days in the economic calendar, but as of late, no matter how grim the numbers, it has only served to inspire the bulls higher. Who knows, perhaps, that trend will continue today.

Asian markets closed mixed but mostly higher overnight fueled on hopes of economic recovery. European markets are currently trading modestly lower this morning as the ECB mulls more stimulus. The US Futures point to a lower open but have pared overnight lows as we head toward earnings and economic reports. As you plan, remember the Employment Situation report Friday morning.

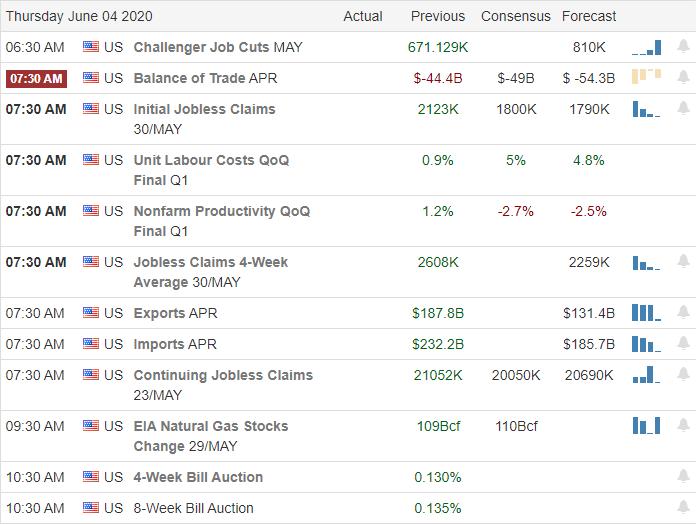

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have our biggest day of quarterly reports this week, with 68 companies stepping forward. Notable reports include DOCU, AVGO, CIEN, DXLG, DLTH, GIII, GPS, HOV, SJM, MIK, SAIC, TTC, MTN, & ZUMZ.

Technically Speaking

Hold on to your seat, everyone I know this will be a surprise, but this morning we have another market gap today! However, rather than gaping up, we see a little profit-taking pressure after a huge bullish day where the Dow rallied more than 500 points. That said, I would not expect the pullback to last long with both the US and the ECB talking about another round of government stimulus. With the NASDAQ testing all-time highs, I’m not sure why they feel the need to stimulate as if debit no longer matters. Health care workers are under pressure as cases in several southern states surge as the US death toll nears 110,000. As protests continue across the country, the officer directly involved now faces 2nd-degree murder charges. Although the protests have become less violent, Las Vegas has pulled an ad campaign encouraging tourism due to the dangerous unrest.

The four major indexes continue in robust bullish trends that I must admit were much stronger than I would have imagined given the protesting disruption that closed and damaged so many businesses across the country. The NASDAQ challenged all-time highs yesterday just before succumbing to some end of day profit-taking. Today, we have our biggest day of earnings reports this week, and we face another Jobless Claims number where consensus suggests more 1.5 million more Americans applied for unemployment. The good news is the number continues to decline, but the total number of unemplyed is staggering. Thus far, no matter how bad the employment news, the market has rallied, hoping things will be sharply better soon. Perhaps that optimism will overcome the bearish gap down this morning after the report. As you plan forward to remember, the Employment Situation number will be out Friday morning before the market opens and is expected to show numbers this country has not seen since the world war.

Trade Wisely,

Doug

Comments are closed.