The hopefulness of the economic reopening and news of a possible democratic 2-trillion dollar stimulus bill written in private continued to inspire the bulls yesterday. As the NASDAQ stretched its rally to 6-days in a row, the DIA, SPY, and IWM continue to struggle with overhead resistance. The range of consolidation is quite wide, adding some danger to a possible pullback. For example, the Dow would have to pull back as much as 1200 points just to test its 50-day average. Plan your risk carefully as we approach price resistance.

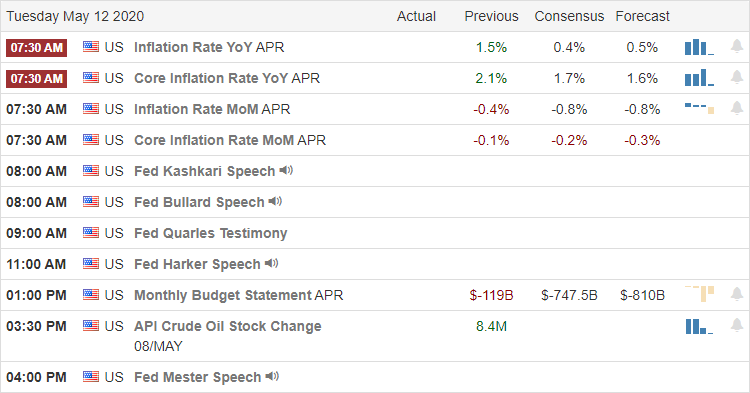

Asian markets closed modestly lower overnight after reporting a miss in inflation data. European markets are mixed as concerns rise over a coronavirus comeback. US Futures are once again trying to put on a brave face pointing to bullish open ahead of the 8:30 AM CPI number that could double the negative reading from last month. Will, it matter or will we continue to ignore? We will find out soon.

Economic Calendar

Earnings Calendar

The Tuesday earnings calendar has just over 150 companies reporting quarterly results. Notable reports include CSPR, DUK, GAIN, HMC, IR, LOGI, MAC, & TM.

Technically Speaking

The NASDAQ reached out for the 6th day in a row as the big-4 continue to carry the majority of the weight. The DIA, SPY, and IWM remain locked in a wide range of consolidation above their 50-day averages but remains challenged by overhead resistance. The bulls are drawing energy from the hopefulness of the reopening of the economy, but health officials are warning that rushing opening will cause undue suffering and death. Who’s right? No one truly knows, and I’m not going to armchair quarterback their decisions, remaining grateful these difficult decisions are not mine! With the death toll now over 81,000 and infections, nearly 1.4 million, I think the recovery will be long and very challenging.

The T2122 indicator suggests that the markets are a bit stretched, but the upside momentum continues to favor the bulls. Goldman Sachs reiterated their belief that the overall market will retract about 20% over the next 3-months while the house democrats attempt to write a 2-trillion dollar stimulus bill in private. One thing for sure, the market has a lot to grapple with as we move forward. Earnings season winding down the market will have to deal with the humbling economic numbers. Today we get the latest reading on the CPI that consensus estimates expect to come in at -0.8, doubling from the prior month. We also have a virtual parade of fed speakers, including comments from Jerome Powell on Wednesday morning. Stay focused on price action and be careful not to overtrade as the indexes test resistance levels.

Trade Wisely,

Doug

Comments are closed.