Everywhere you look, there are trending charts, stock holding support levels, and great trading patterns displayed. However, on the other side, there is a growing concern of recession, rampant unemployment, and consumer debit hitting record highs. All the problems thus far have been masked by government stimulus, but one wonders just how long that can continue. What I’m saying is don’t become complacent and remember we have the Employment Situation number coming out Friday morning, and it will be hard to ignore.

Asian markets closed mixed overnight, and European markets are seesawing between mild bullishness and bearishness this morning. Ahead of the ADP report and a huge day of earnings reports the US futures to point to another gap up open. Stay focused on price and remember a moring gap and easily be met by profit-takers.

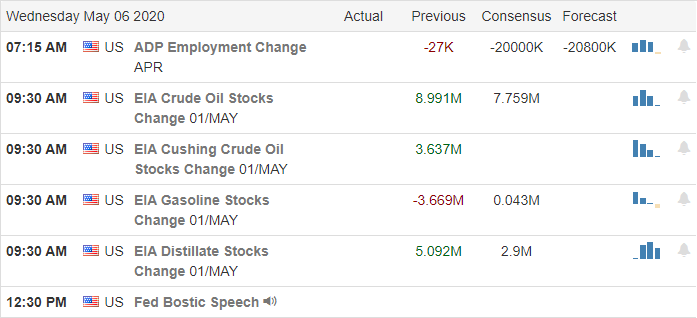

Economic Calendar

Earnings Calendar

Hump day is a busy day on the earnings calendar, with 475 companies stepping up to report. Notable reports include PTON, DDD, ALB, AEP, AWK, AMP, APA, AVB, GOLD, BG, CCL, CARS, FUN, CTL, COTY, CVS, DISCA, EPR, ETSY, EXAS, STAY, FTNT, FOSL, GM, GPC, GDDY, GRUB, H, IAC, LYFT, MRO, MET, NYT, ODP, PZZA, PYPL, RMAX, SHB, SMG, SHOP, SQ, TMUS, TWLO, WM, WEN, WING, WYND, & ZTS.

Technically Speaking

It was great to see so many profits taken yesterday with the follow-through bullish price action. It looks as if those that continued to hold overnight will see additional rewards this morning. However, as we head into the jobless claim numbers on Thursday and the Employment situation on Friday morning, it may be wise exercise a bit more caution. Everywhere you look, there are trending charts showing bullish patterns, but let’s keep in mind in just 3-days the Dow will have recovered 700 to 800 points from Monday’s low will once again test overhead price resistance. Concerns of recession, mounting consumer debt, and the massive unemployment began to gain some traction yesterday after a Fed member painted a pretty grim picture going forward.

After the bell, the DIS report displayed the massive impacts of the virus and suggested the full effects will happen next quarter. One benefit they did enjoy was the tremendous increase in their streaming subscriber base that topped 54 million. Today the market will grapple with another 475 earnings reports and an ADP number at 8:15 AM Eastern with a consensus estimate of 20 million jobs lost. So far, the market has been able to ignore the unemployment, choosing to focus on governmental stimulus. That may be the case today, but I’m not sure the Friday number will easily be glossed over unless we hear of another big check from the government on the way. I guess what I’m saying is not to become complacent. Stay focused and take those profits the market provides because anything is possible.

Trade Wisely,

Doug

Comments are closed.