The FOMC reiterated it would do whatever is necessary for as long as it is needed to bolster the struggling economy. Powell also called on Congress to provide some more stimulus as unemployment approached a historic 30 million. A good round of tech earnings after the bell is also encouraging the bulls even though the indexes appear very extended. With a big day of earnings and economic reports, expect the wild price volatility to continue.

Asian markets rallied on the hope of a coronavirus treatment overnight. European markets have chopped between gains and losses this morning as they cautiously monitor economic data. US futures are also very choppy this morning, heading for one of the strongest monthly rallies in decades. Amazing considering the state of the economy and unemployment.

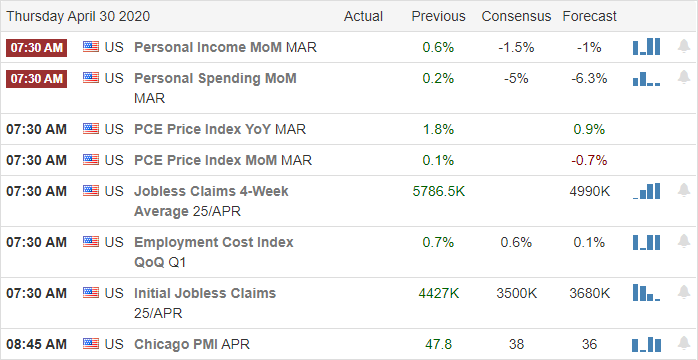

Economic Calendar

Earnings Calendar

The Thursday earnings calendar has more than 400 companies reporting results. Notable reports include AMZN, AAPL, FLWS, MO, AAL, CHD, CI, CMCSA, COP, COR, DOW, DNKN, EXC, EXPE, FSLR, BEN, GILD, GT, HBI, IRM, K, KHC, MCD, MGM, TAP, MNST, PLNT, PSA, SPG, SIX, SO, SWK, TWTR, V, WELL, WDC,& WHR.

Top Stories

Jerome Powell said there is a need for more stimulus if we’re to see a robust recovery from the coronavirus crisis. The FOMC has committed to keeping rates near zero until we see a return to full employment and a return to inflation. The chairman said he expects the virus will affect the economy for another year, and the massive unemployment will be challenging to recover.

The GDP declined for the first time in a decade, falling more than economists had expected as consumer spending declined sharply. The outlook for the 2nd quarter is grim but also very unclear because of the unknown of the economy reopening and the possible resurgence of infections.

Today the nation’s joblessness is expected to rise to nearly 30 million or more. In a matter of a few weeks, America went from record employment to historic unemployment. Thus far, the market has been able to ignore these numbers, but the sharp decline in consumer spending reflected in the GDP number will make it challenging to ignore forever.

Technically Speaking

The bulls can’t seem to buy enough risk despite the disappointing GDP numbers and record unemployment rising more than 500 points yesterday. The T2122 indicator has pegged at the top of the range as the rally continues to extend. Yesterday the FOMC gave the bulls confidence once again reiterating they will do whatever is necessary for as long as they need to support the struggling economy. However, Powell believes Congress will have to help out with additional stimulus spending expecting the historic unemployment situation to impact the marketplace for another year.

A good round of tech earnings after the bell is also helping to bolster the bullish sentiment even though the indexes prices appear very extended. Today we have more than 400 companies reporting, including AAPL and AMZN, after the bell. We also face another disappointing jobless number before the market open that could raise the unemployed number above 30 million. I know its hard to rationalize the horrific economic numbers against what we see as the market rallies. All we can do is stay focused on price action riding this bull rally as long as it lasts because there is no telling how long or high it can go. Just be prepared with a plan if it should suddenly stop and reverse to protect your profits.

Trade Wisely,

Doug

Comments are closed.