The bulls are in charge and don’t want to be bothered by falling oil prices, bankruptcies, massive unemployment, or negative earnings growth. Today begins the 2-day FOMC, where its hoped we will get some clarity on how long rates will remain low and the extent of the asset purchase programs. However, it is unlikely the committee will make a change to current interest rates.

Asian markets were little changed overnight as oil continues to slide south, and HSBC’s earnings drop. European markets are trading in the green across the board with gains above 1.25% as they eye earnings results. Ahead of a big day of earnings and economic data US Futures power higher with the Dow expected to gap up more than 250 points.

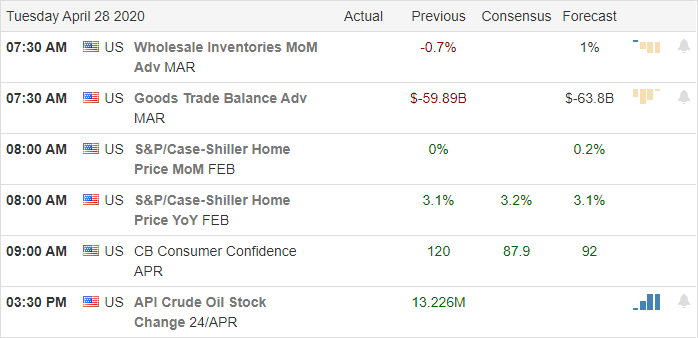

Economic Calendar

Earnings Calendar

The Tuesday earnings calendar is a busy one with nearly 250 companies reporting results. Notable reports include MMM, ABB, AMD, AB, GOOGL, BP, CAT, CNC, GLW, CMI, DENN, DHI, ECL, FEYE, F, HOG, MRK, MDLZ, NVS, NUE, PEP, PFE, ROP, SPGI, LUV, SBUX, TROW, TRU, UBS, UPS, & YUMC.

Top Stories

The administration unveiled a strategy to help states ramp up their capacity to test for coronavirus, hoping to raise public confidence as state’s begin to restart their economies. Health officials continue to warn that restarting to soon could create another spike in infections. Who’s right? Only time will tell.

The FOMC begins its 2-day meeting today but is unlikely to change the benchmark interest rate. However, they may provide more clarity about the duration of the low prices and the scale of asset purchases to stabilize the market.

Oil falls 20% on storage capacity fears and weak worldwide demand in the wake of the pandemic. However, the slide in prices has done nothing to dissuade the bulls as the market continues to stretch into overbought territory.

Congress will soon return to the hill to work on yet another stimulus plan that may include a provision for guaranteed basic income. The suggestion is anyone making less than 130K per year could receive a $2000 per month payment from the government for the duration of the pandemic crisis. Of course, an actual plan is likely to be very different.

Technically Speaking

While the T2122 indicator suggests an overbought condition and oil prices dropped 20% yesterday, the bulls continued to power forward. Although the 50-day moving average continues to decline, the DIA and SPY joined the QQQ by closing above this key psychological indicator. A growing number of company bankruptcies, negative earnings projections, and historic unemployment levels appear to be of little concern these days as investors seem to have a ravenous appetite for risk. I don’t understand it, but the good news is that I don’ have to as long as I focus on price action and stick to my trading plan. Sooner or later, there will be another market pullback, but until that time, set aside your bias and trade the tend.

Ahead of a big day of earnings and several economic reports, the futures indicate another gap up open. MMM is rising on strong demand for its pandemic safety devices this morning, which makes sense, but CAT reported a 21% decline in sales and is indicated higher. Go figure? Needless to say, the bulls are in control and look to make a powerful statement at the open. Be careful not to chase and remember big gaps can bring in profit-takers, so it would be wise to stay focused on price action clues.

Trade Wisely,

Doug

Comments are closed.