A massive week of earnings and a jam-packed economic calendar that includes an FOMC meeting will give traders and investors an awful lot to digest this week. This morning US futures are ignoring the 16% decline in West Texas crude pointing to a gap up open that looks to challenge the current consolidation resistance in the DIA, SPY, and QQQ. With so much data coming our way expect substantial price volatility to challenge even the most experienced traders.

Asian markets rallied overnight as the Bank of Japan continues to ease monetary policy. European markets hoping for further lock-down easing are bullish across the board this morning. US Futures that opened in the red yesterday now suggest a gap up open of more than 200 down points. This week the market may be a lot of things, but boring is not likely to be one of the descriptions.

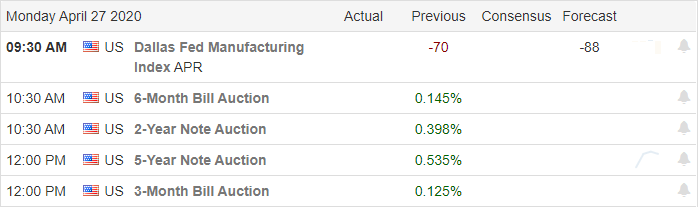

Economic Calendar

Earnings Calendar

We have a hectic earnings calendar this week, and we kick it off with more than 160 companies reporting results. Notable reports today include BRO, CE, CINF, CLR, CRSP, FFIV, KDP, NXPI, OMF, PKG, and PPG.

Top Stories

Oil is once in again in decline this morning with West Texas crude futures down more than 16% at just over $14 a barrel. However, US Futures are choosing to ignore the slide in oil prices this morning, pointing to a higher open.

Adidas reported a 19.5 decline in sales in the first quarter and projected a 40% decline for the second quarter. Although their online sales have increased consumer habits, have changed as people are staying home due to the virus.

This week several states will try to reopen some business with imitations that continue to promote social distancing. Many health officials suggest it’s too early, and with a shortage of testing, the possibility of higher infection rates may occur. What they found in Europe that even as stores reopened, consumers continued to stay away, fearing contamination, suggesting recovery will be a complicated process.

Technically Speaking

The DIA, SPY, and QQQ have traded sideways in a broad consolidation range that covers about 1700 Dow points between support and resistance. With futures choosing to ignore the 16% slide in West Texas crude, it looks as if we will test the resistance levels with a gap up open this morning. The T2122 indicator at the open is likely to warn of an over-extended condition, so be careful rushing in with a fear of missing out. With funding for small business restored last Friday with another stimulus bill loans will begin later today. However, they are already saying the money will be gone quickly, and additional funding will be required. Back to work, congress!

We have not only a jam-packed earnings calendar for the market to digest but also a busy week on the economic calendar that includes and FOMC meeting. As US infections approach 1 million, the death toll tops 55,000, and unemployment numbers head toward great depression levels expect price action to remain very challenging with possible intra-day reversals and significant overnight gaps. With the SPY opening, this morning 30% above the market lows I wonder how much longer the bulls can maintain the upward pressure.

Trade Wisely,

Doug

Comments are closed.