A hopeful virus treatment from GILD and the President presenting a 3-phase plan to begin reopening the economy has the futures hopping and popping this morning as we head into the weekend. This morning’s gap will bring the DIA and the SPY up to test their 50-day averages. Good news for sure, but let’s not forget that more than 20 million Americans are unemployed, and states are running out of funds to cover claims. Stimulus checks have been delayed, and the small business loan program is nearly out of funds. I guess what I’m saying is be careful, chasing this huge gap with the fear of missing out!

Asian markets rallied overnight despite a 6.8 quarterly contraction in the economy and a doubling the virus death toll sitting accounting lapses. European markets are decidedly bullish this morning with the DAX and CAC up more than 4%. US Futures point to a massive gap up heading into a very light day on the economic and earnings calendar. Let’s party, but keep in mind next week we jump headlong in earnings next week. Plan your risk carefully!

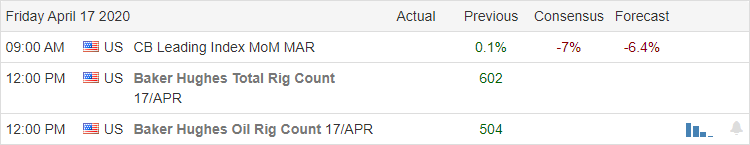

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have a little lighter day with just 27 companies reporting results. Notable reports include KSU, MUSA, RF, & STT.

Top Stories

China says its economy shrank by 6.8 in the first quarter by 6.8%, which is the first quarterly contraction in over 28 years. They have also more than doubled the death toll from the virus calling it accounting lapses. Hmm?

The President announces a 3-phase plan to reopening the economy. However, 7-eastern states have already announced they will remain shutdown until May 15th. Sadly the yesterday’s daily death toll nearly doubled the all-time daily high, suggesting just how difficult and uncertain when things may get back to normal.

GILD says their treatment trial is showing promising results but also careful to say there is a lot of testing to go before a treatment protocol is approved and available for mass production.

Technically Speaking

The jobless in this country now total more than 20 million, states are out of unemployment money, and the small business loan program is also running out of money. Banks slid sharply south yesterday, but the market does not seem care as the steep rally continues even as recession looms. Due to what the government calls, glitches have delayed stimulus checks to reach the public. I suspect we will soon hear that more stimulus programs needed and further debit spending on the way.

Yesterday saw the daily death toll nearly double the previous daily record, but despite that, the President unveiled a 3-phase reopening plan putting states in charge of the decision. The announcement that GILD has promising results from early-stage trials has the market leaping higher this morning even though an approved treatment is likely still more than a year away. Back in the old days, they called that market manipulation, but today the market wants to grab on to any ray of hope choosing to ignore the longer-term impacts. So be it, but be very careful chasing such a massive gap heading into a weekend. Next week we dive headlong into 2nd quarter earnings so plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.