After a dismal round of economic numbers, the bears launched another attack yesterday. Still, the bulls met the challenge holding the selloff above the short-term uptrend and essential price supports. The tech sector remains the strongest as the QQQ holds above the 50-average showing incredible tenacity amid ugly earnings results. Now the focus turns once again the Weekly Jobless claims that so far, the market has been able to shrug off choosing to focus on the FOMC operations. Will the same be true today? Only time will tell!

Asian markets closed mixed overnight, recovering early losses after Australia’s jobs data came in better than expected. With Germany announcing plans to ease the countries lock down European markets cautiously rally this morning. US futures recovered overnight loss and now point to a modestly bullish open ahead of earnings and economic reports. Remember to stay focused on price.

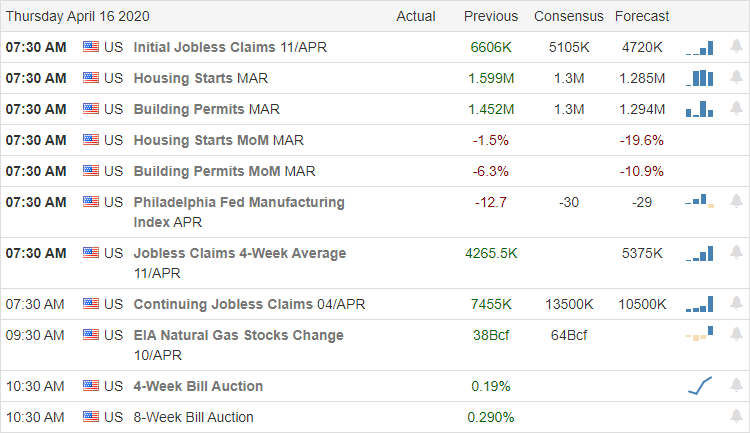

Economic Calendar

Earnings Calendar

On this Thursday Earnings Calendar, we have just over 80 companies reporting results. Notable earnings include ABT, BLK, BK, BX, DHR, DOV, HON, KEY, RAD, SKX, & TSM.

Top Stories

The total number of infections worldwide tops 2 million and over 134,000 people have died. Singapore’s health ministry reported a reemergence of the virus with 447 new infections, while Germany plans to cautiously ease the lockdown.

The IMF warned overnight that it expects Asia to have a zero percent growth rate in 2020 and calling it the worst performance in nearly 60 years as a result of the outbreak.

President Trump stated yesterday that the US has passed the peak of the virus growth, and those lock-down efforts have been successful in slowing the spread. That’s great news, but with the death toll still rising and new hot spots emerging around the country when we can begin ending the lockdown is still unclear.

Technically Speaking

After such a steep rally in the market, yesterday’s selloff amid ugly earnings and shockingly bad economic numbers was not a big surprise. The surprise is how well the market handled the bad news with the bulls working very hard to defend price support levels and even finding the energy to rally by the end of the day. Overnight futures traded lower, but after Australia reported better than expected jobs, numbers markets around the world began to improve. Hopeful news that Germany plans to ease lockdown restrictions and the President saying the US has crested provided additional levity allowing the futures to recover and turn positive.

The DIA, SPY, QQQ, and IWM all held above the short-term uptrend and critical price support levels. The QQQ remains the technically strongest index having recovered its 50-day average with the IWM drags along behind as the weakest. Gold and Bonds were strong yesterday as fears rose early in the day after very disappointing retail sales and housing numbers were released. This morning US Futures point to modestly bullish open ahead Housing Starts, Jobless Claims, and the Philly Fed Survey, including several notable earnings reports. To date, the market has been able to shrug off the historic unemployment numbers perhaps today will be the same with expectations of 5 to 6 million new claims. Anything is possible, so stay focused and stick to your rules.

Trade Wisley,

Doug

Comments are closed.