From record market highs to bailout conditions in less than a month! Oh, how the tables have turned by a microscopic virus wreaking havoc around the world. A punishing day that saw heaving selling in every sector of the market, and a barrage of bad news that points massive economic impacts in the weeks and months to come. With so much uncertainty facing the market, anything is possible, and it seems government money can’t buy back investor confidence facing a pandemic.

Asian markets finished the week in the red, with Japan closing more than 6% lower on the day. European markets are in bounce mode this morning, rallying more than 5%. After a very turbulent night, US Future now points to a Dow gap up of more than 1000 points as this will price action rollercoaster ride heads into the uncertainty of the weekend. Plan your risk carefully because anythings possible by Monday morning!

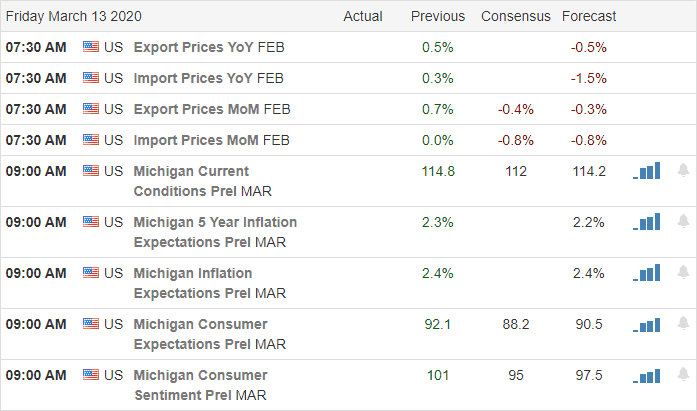

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have just short of 70 companies reporting quarterly results. Notable reports include BKE & GOGO.

Top Stories

Another rough market day triggering circuit breakers with the Dow suffering the worst one day plunge since 1987 even as the Fed stepped up with half a trillion dollars. A barrage of virus news with professional sporting teams suspending seasons and large venue closures in an attempt to control the virus spread.

Although its Friday the 13th, there is a favorable breeze blowing in the pre-market after a wild night of price volatility in the futures markets. Japan sold off sharply last night, dropping as much as 10% at one point, pushing Dow futures down as much at 700 points. However, the bulls have come roaring back with a substantial gap up in prices at the open today. Cross your fingers that it can hold heading into a weekend that’s not likely to provide better news on the virus front.

Technically Speaking

Index charts, as well as most stock charts, are in an ugly technical condition. The Dow dropped like a hot knife through butter closing well below the 2018 low nearly 19% below its 500-day average. The SP-500 finished the day just short of 14% below its 500-day with the Nasdaq composite 8.5% below. The failure in the Russel is epic, closing more than 28% below its 500-day average. What happens next is anyone’s guess, as the economic impacts of the outbreak continue to compound. Some analysts are suggesting the market could lose half of its value by the time this is over, and the full measure of damages totaled. Congress is working on some kind of relief package, but according to reports, it will be next week before a vote occurs. The silver lining to all of this is that great stocks are reaching bargain prices for those willing to hold through what is likely going a very turbulent market for weeks or even months to come. As we head into an uncertain weekend, plan your risk carefully because anything is possible by Monday morning.

Trade Wisely,

Doug

Comments are closed.