After cutting the interest rate by 50 basis points the market appeared to have a bit of a temper tantrum showing its disappointment with the Dow closing down nearly 800 points on the day. The president also expressed disappointment calling for a much deeper cut. However, after the big win of Joe Biden on Super Tuesday this very emotional market is in rally mode even though this sets up a party battle for remaining delegates that could go all the way to the convention. We should expect another wild news-driven day as virus news continues to cloud the path forward with tremendous uncertainty.

During the night Asian markets closed mixed and nearly flat as auto sale and service sector numbers plummet as a result of the outbreak. European markets have recovered early losses and are green across the board while here in the US the futures market points to a huge gap up as this wildly emotional market flop’s all over the place. Traders should plan for the extreme price volatility to continue as we once again approach another uncertain weekend.

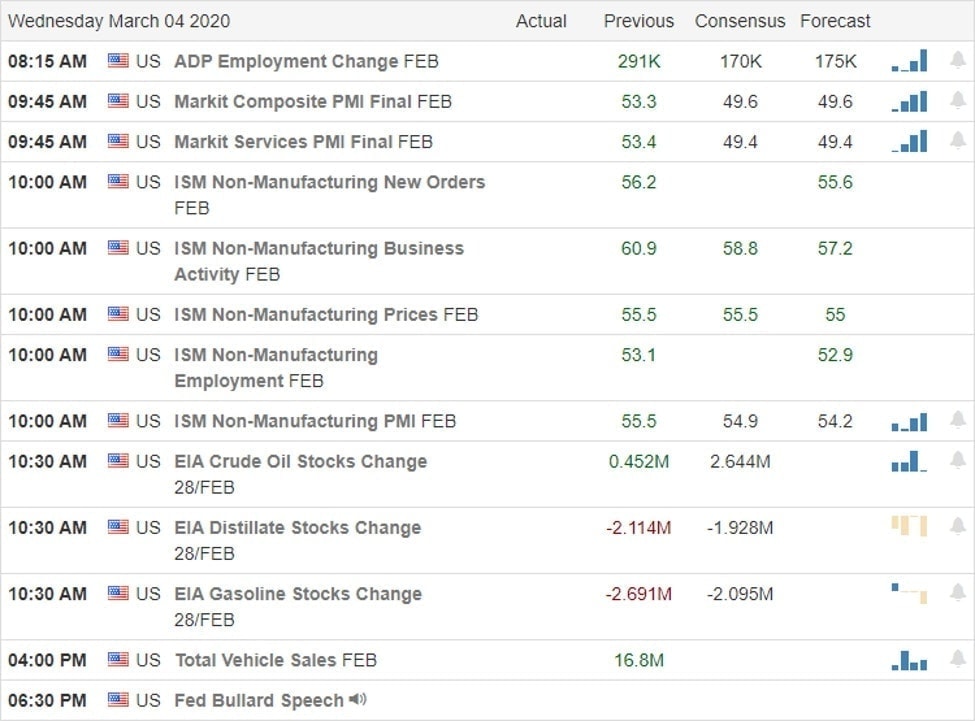

The Economic Calendar

The Earnings Calendar

On the hump day earnings calendar we have about 130 companies reporting results. Notable reports include ZM, ANF, AEO, CPB, DLTR, GWRE, MRVL, OMI, SPLK, & PLCE.

Top Stories

During the night China reported that vehicle sales dropped 80% and the service sector is down 70% as impacts from the outbreak begin to roll out.

After cutting the rates by 50 basis points the market shot up nearly 700 points in just 7 minutes but in a very volatile session ended the day down with the Dow losing 800 points.

Joe Biden pulled off a huge victory last on Super Tuesday pulling ahead in the delegate count but with wins in California and Colorado Bernie Sanders has enough delegates to set up a party battle into the convention. It’s going to be a wild election year but it would seem the market is happy that Biden has emerged as the front runner with US Futures pointing to a substantial opening gap.

Technical Speaking

Yesterday’s wild price action volatility moved prices so fast you might have felt a bit seasick just watching the swings. At the end of this wild ride the Dow had once again failed its 200-day average and the IWM closed back down near its 500-day average. The QQQ fell back below the 50-day average while the SPY edged down toward its 200-day. Dark cloud cover candle patterns were left behind on all the indexes but with such extreme volatility I’m not sure that means all that much. As the US cases of the virus continue to grow we should also see the high volatility continue with so much uncertainty ahead. As of now US Futures point to a huge gap up seemingly reacting to last night’s election results but keep in mind as news of the virus spread continues to roll anything is possible in the days and weeks ahead. Hold on tight this rollercoaster ride may have just begun.

Trade Wisely,

Doug

Comments are closed.