Shaking off any and all concerns of potential economic impacts from the coronavirus buyers pushed up the SP-500 and Nasdaq setting new record highs. How long this can continue is anyone’s guess but traders should be very careful not to become complacent over-trading a rally that is already quite extended. Although the price action of MSFT appears, parabolic buyers didn’t hesitate to push the stock up making the company the biggest company in the world by valuation yesterday. With a big day of Fed speak, more than 100 companies reporting and the New Hampshire caucus anything is possible.

Asian markets closed mixed but mostly higher overnight as Chinese banks scramble to support business requiring huge capital injections due to the outbreak impacts. European markets are bullish across the board on positive earnings results. US Futures indicate another gap up open and more new records as the rally continues to extend with no concern of future virus related impacts.

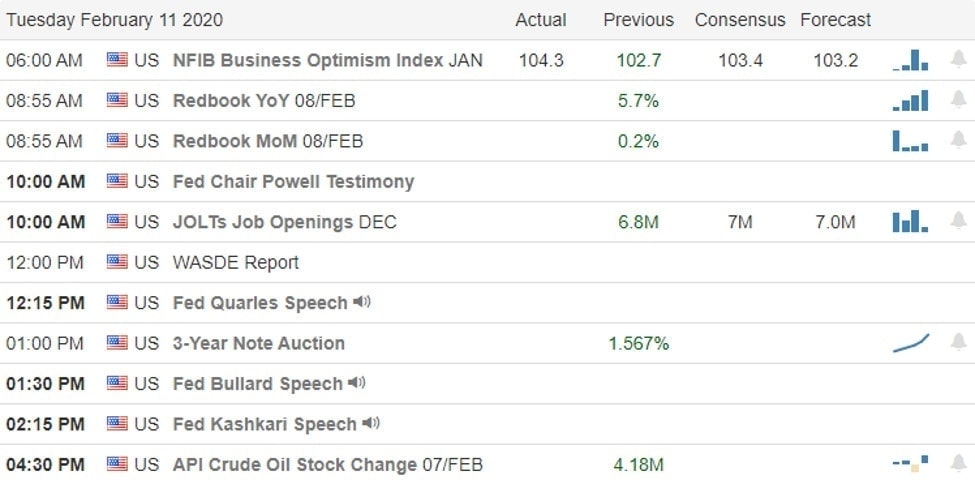

On the Calendar

On the Tuesday earnings calendar, we have a busy day with more than 100 companies reporting quarterly results. Notable reports include AKAM, AN, DENN, DBD, D, EXAS, EXC, GT, GRPN, HAS, HILT, LPX, LYFT, MAS, MLCO, NNN, ONDK, TGNA, UAA, VIRT & WU.

Action Plan

The bulls continue to shake off coronavirus concerns and the obvious economic impacts pushing the SP-500 and Nasdaq to new record highs on Monday. While the absolute breadth index (T2101) remains in a month over month downtrend select, large market cap companies continue to lift the indexes. The relentless buying without regard to valuation is very reminiscent of the 1999 tech bubble though the economic particulars are very different. A report yesterday suggested GDP may fall by as much as 50% due to the outbreak impacts on the economy in the coming months. However, in the short-term earnings continue to inspire the bulls to buy. Yesterday, MSFT rose to the top, becoming the biggest company by valuation in the world pushing the chart into the parabolic territory.

Along with a big day earnings report, we have several Fed speakers, including comments from Jerome Powell at 10:00 AM Eastern. Although we are unlikely to learn anything new for the chairman, any inclination of dovishness or hawkishness can move the market so stay focused on price action for clues. On the campaign front, the Democrats are hoping to shake off the Iowa debacle, gain some momentum in the New Hampshire caucus today. So far, the field remains split and there is no clear front runner as voting begins. The results of the contest could have market impacts for traders to consider on Wednesday morning. Futures indicate yet another gap up open to record highs. How long this continues is anyone’s guess, but be very careful not to chase or become complacent.

Trade Wisely,

Doug

Comments are closed.