A mixed bag of earnings results and a growing outbreak now approaching 25,000 infected is no deterrent for the ravenous bulls as the QQQ leaps to new record highs yesterday and is once again gaping sharply higher this morning. Let’s party like it’s 1999, but be careful chasing stocks already extended. Plan your trades carefully at or near price support levels with a logical stop in place in case the music suddenly ends. No one knows when that might be so follow your rules, avoiding those emotional mistakes that can prove very costly when we get caught up in the chase.

Asian markets were once again green across the board overnight, with China regaining another 1.25% after selling off 7% on Monday. European markets and US Futures both turn higher after and unconfirmed Chinese TV report of a dug break-though for the corona outbreak. Anything is possible with a big day of earnings and economic reports, so expect the wild price action to continue.

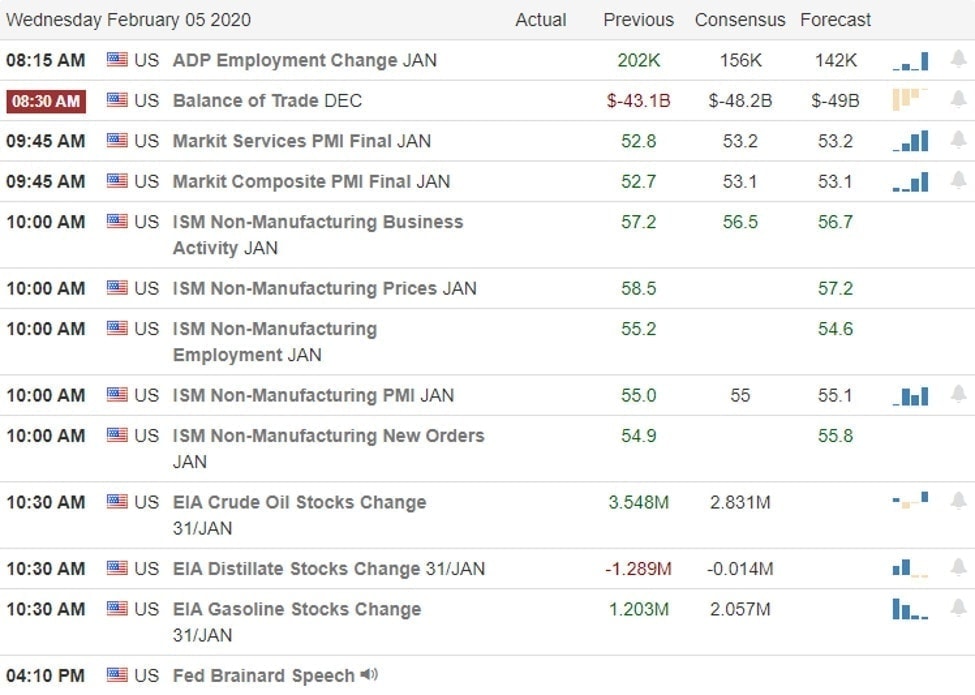

On the Calendar

On the hump day earnings calendar, we have a busy day with more than 160 companies stepping up to report. Notable reports include ABB, AVB, BSX, ELY, CINF, COTY, ELF, ENR, FEYE, FLO, GM, GPRO, GRUB, HUM, IAC, IRBT, MRK, MET, OHI, ORLY, QCOM, RGLD, SAVE, SPOT, TWLO, YUMC, & ZNGA.

Action Plan

An early morning rally in the US Futures rally after a Chinese TV report of drug breakthrough for the coronavirus. Even though the story is unconfirmed, this emotional market lept up nearly 300 points in early morning trading. As of last night, there are nearly 25,000 confirmed cases and more than 490 deaths. American and United announced overnight they are stopping flights to Hong Kong and Princess Cruise Line quarantines 3700 passengers after confirming 10 cases of the virus on board. Disney reported is expects a 175 million impact for the closing of its parks in China, and analysts have started to adjust next quarter expectations on companies exposed to the virus outbreak. NKE reported possible production delays due to their material supply chain from China is experiencing significant delays.

Despite the pending impacts, the US markets continue to rip higher with the QQQ setting a new record high yesterday. If fact, it would seem that the ravenous appetite to buy already extended stock prices has increased. Even stocks that appear to be in parabolic patterns such as TSLA continues to attract buyers with seemingly no concerns about price. I am not saying the conditions are the same but the relentless buying is reminiscent of the tech run-up in 1999. Though I risk sounding like a broken record, traders should guard themselves against chasing stock prices without regard to the last price support. You don’t want to be the last person looking for a chair when the music stops.

Trade Wisely,

Doug

Comments are closed.