Today brings another big day of earnings and economic reports punctuated by the FOMC rate decision at 2:00 PM Eastern. AAPL reported strong earnings results yesterday, but by in large the yesterday’s round of earnings was rather disappointing with PFE, MMM, SBUX, AMD, & EBAY moving lower after reporting. Even with the virus outbreak cases rising above 6000, futures markets are still pushing for a bullish open on the back of the AAPL result and in hopeful anticipation of better reports today. Anything is possible, so plan your risk carefully.

With the extended lunar holiday, China’s market remains closed but Hong Kong fell as much as 3% overnight in reaction to the virus economic impacts. European markets are cautiously shaking off the coronavirus concerns sporting modest gains across the board this morning. US Futures opened trading positive last night and has managed to maintain the bullishness all night. Futures point to a gap up open ahead of earnings reports and economic news and the FOMC.

On the Calendar

On the hump day earnings calendar, we have 150 companies fessing up to quarterly results. Notable reports today include but not limited to TSLA, ANTM, ADM, ADP, AVY, APRN, BA, EAT, CP, CRUS, GLW, DOW, DRE, ESS, FB, GD, GE, ILMN, LRCX, LVS, MPC, MKTX, MA, MCD, MSFT, MAA, MDLZ, NSC, NVS, PYPL, PGR, ROK, RCL, NOW, SWK, & TROW.

Action Plan

Although yesterday’s round of earnings was a bit disappointing, AAPL’s beat seems to be enough to inspire the bulls in the future markets higher. There also seems to be a lot of bullish anticipation for the huge round of earnings today. The coronavirus outbreak has now surpassed the 2003 SARS outbreak, with now more than 6000 confirmed cases with 132 deaths as this health crisis continues. The President has now stopped all flights between the US and China, and SBUX was the first company to admit the outbreak will negatively affect future earnings. Interestingly enough, the market appears unconcerned with the futures currently pointing to modest gap up open.

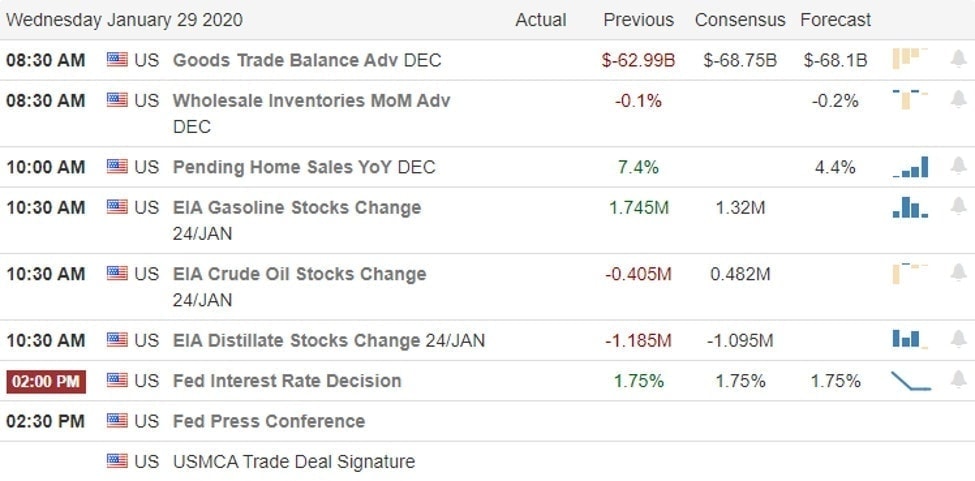

The market will also have plenty to digest on the economic calendar with International Trade in Goods, Pending Home Sales, Petroleum Status, and of course, the FOMC rate decision at 2:00 PM eastern. With yesterday’s rally, the indexes are testing or near price resistance levels. As I looked through my watchlists yesterday, the majority of the stocks were also pushing up into resistance levels providing relatively high-risk trades. Traders should guard themselves against overtrading at price resistance and avoid chasing with the fear of missing out guiding your decision making.

Trade Wisely,

Doug

Comments are closed.