With a partial trade deal, no new tariffs, and the FOMC behind us, the market breathed a sigh of relief, setting new records in the DIA, SPY and QQQ. Now the question is, has the market already priced in this good news, or will the bulls continue to find inspiration allow for a Santa Clause rally into the New Year? Although the full House is preparing to vote on the presidential impeachment, it has thus far only served as a distraction rather than impacting this tenaciously bullish run. As of now, the bulls remain in control, and the index trends continue to point higher. As always, stay focus on price action watching for clues of change.

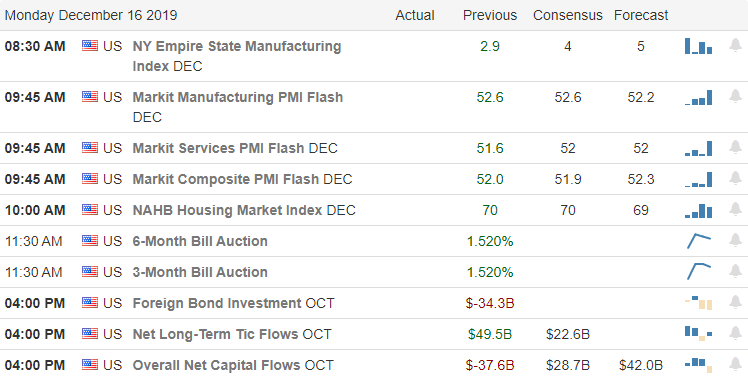

Overnight Asian markets closed mixed but mostly lower even amid better-than-expected industrial output. Across the pond, the Stoxx 600 hits new record highs in response to the US/China deal as European indexes see only green this morning. Not to be outdone, the US Futures point to modest gains at the open ahead of several economic reports with PMI numbers the most potentially market-moving.

On the Calendar

On today’s Earnings Calendar, we have 22 companies reporting quarterly results, but there are no particularly notable reports.

Action Plan

Friday was a day of wild volatility as the market reacted to the US/China trade news. Removing the December tariffs proved to be a big relief to the market but as we learn about what’s in the trade deal, it will be interesting to see how the market responds. Has the deal already ben priced in, or will it continue to inspire the bulls? One thing for certain with new record highs printed in the DIA, SPY and QQQ on Friday the trend is up and the bulls at this point remain in control.

With just nine days until Christmas, trade deal, tariffs & FOMC behind us, the stage may be set for a Santa rally taking us right into the New Year. One possible stumbling block is the impeachment process that may serve as a distraction but, the market to this point has had little concern as the political drama heads to the full House for a vote. As I write this note, the Futures point to bullish open ahead of manufacturing, PMI, & housing numbers. Be careful chasing the morning gap by waiting to see if buyers follow-through to avoid the possibility of a pop and drop bull trap.

Trade Wisely,

Doug

Comments are closed.