Impeachment, Tariffs, and Brexit, Oh My! While the House impeachment committee prepares a Thursday vote charging the president with high crimes and misdemeanors, citizens of Britain go to the polls as the Prime Minister fights for a majority. What a tangled web of uncertainty the market faces as we wait. After learning that the FOMC will hold the line on interest rates and the positive economic comments by the Chairman, the DIA, SPY and QQQ closed with modest gains. One wonders if they can continue to remain so brave if we head into the weekend still waiting on a presidential tariff decision.

Overnight Asian markets closed mixed but mostly higher as they closely monitor trade and tariff developments. European markets are moderately green across the board as the watch developments in the UK election and wait on an ECB rate decision with Christine Lagarde at the helm. With an impeachment vote pending, US Futures are pointing to modest gains at the open as the President prepares to meet with trade advisers. Keep a close eye on price action for clues as we wait for possible market-moving news.

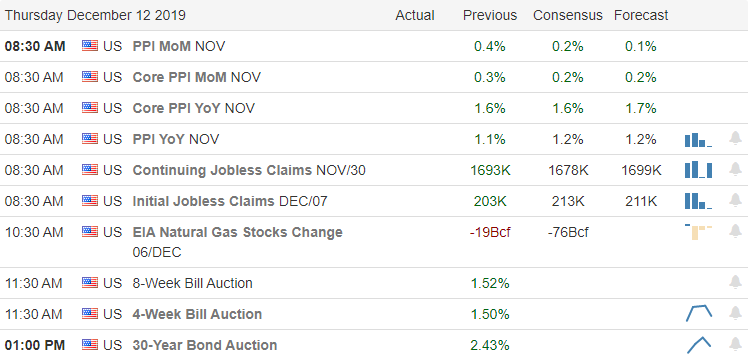

On the Calendar

On the Thursday Earnings Calendar, we have 22 companies reporting quarterly results. Notable reports include COST, ADBE, AVGO, CIEN, ORCL.

Action Plan

After cutting the interest rates three times in 2019, the FOMC decided to stand pat and have encouraging words about the overall economy. As expected, there was very little price movement after the release, but the bulls finally manged a positive Dow close by the bell. The house impeachment committee debated late into the evening with a vote likely to occur sometime today, sending the articles to the full house vote. Across the pond, British citizens are voting today in an attempt by the Prime Minister to win a party majority that will pass his Brexit deal. Should his party win gain, the majority needed the Brexit deal could occur rather quickly and may affect the overall market. Should they lose, the opposing party promises a new vote to determine if the country wants to proceed with Brexit at all.

As we wait for the decision on the Dec 15th tariffs, the bulls have done a very good job of defending the overall index trends. However, as the weekend approaches, one wonders how long they will remain this brave in the face of so much uncertainty. Futures are modestly bullish this morning ahead of the Jobless Claims, and PPI reports. After the bell, we will hear from ADBE, AVGO, COST, & ORCL earnings that could prove to be market-moving. A confusing and worrisome market to be sure so plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.