Articles of impeachment, pending tariffs, or phase one deal, and a pending FOMC decision is a trifecta of uncertainty and possibly the perfect storm for price volatility. This morning the bears are reacting to the uncertainty but we could be just one news report or tweet away that from triggering major sentiment shift. What comes next is anyone’s guess and the question we much answer is how much risk are we willing to take while we wait for the next shoe to drop. If it happens during the day, traders can react, but if it occurs overnight, traders will have have to deal with the aftermath. Consider your risk very carefully!

Asian markets closed mixed but mostly negative as China consumer inflation jumps in November and pork price surge 110 percent. Across the pond, Eurozone indexes are red across the board as they closely monitor the approaching tariff deadline. US Futures indicate the bears are once again making a push lower this morning with the Dow pointing to 100 point gap down ahead of earnings and economic reports.

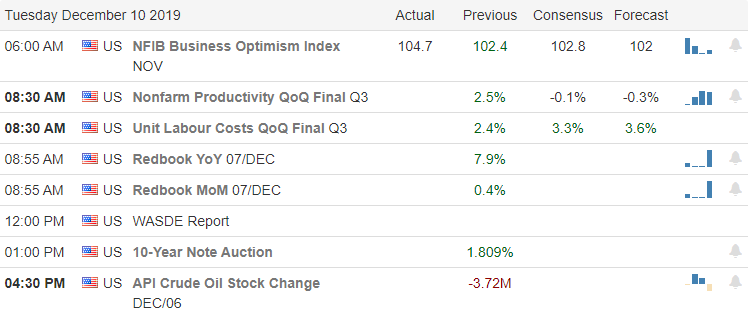

On the Calendar

On the Earnings Calendar, we have 26 companies stepping up to report quarterly results. Among the notable reports today are GME, AZO, PLAY, & OLLI.

Action Plan

It would appear that Congress has made some progress may finally complete the North American trade deal that has been languishing for many months. At the same time, the House has prepared articles impeachment that may be released as early as today and voted on by the end of the week. While all this political drama has been unfolding, the market has been holding its breath, waiting for clarification of the Phase 1 trade deal with China or if there will be a new tariff increase this Sunday. Monday’s sideways chop displayed the uncertainty of the market. According to the reports, China has agreed increase its soybean purchases and reported pork price spiked 110% in November.

As we wait for some clarification, the bears have come out to play with futures markets pointing to lower open this morning. A little fear seemed to creep into the thinking of the market yesterday with the rising 16% as the indexes price chopped sideways. Today begins the 2-day FOMC meeting with an announcement scheduled for 2:00 PM Eastern Wednesday. Although they have projected a wait a see approach on further rate cuts, waiting for their actual decision always adds a twinge of uncertainty for the market to work through.

Trade Wisely,

Doug

Comments are closed.