The big morning gap yesterday seemed to be met with a lot of uncertainty as to what happens next with the Phase 1 trade agreement. The bulls find very few buyers after the gap, and the bears could not inspire any sellers, so we lingered the rest of the day in a choppy sideways consolidation waiting for news to break the deadlock. Although the uncertainty remains, the futures market that had been flat most of the night found some inspiration somewhere to once again point to a bullish gap up open.

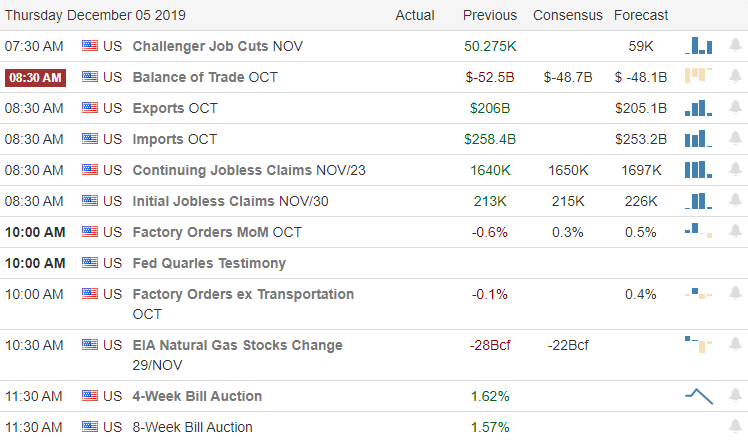

Asian markets closed positive across the board overnight as confusion over the trade continues. European markets are trading mixed but mostly higher this morning ahead of German economic data. US Futures point to a 100 point Dow gap ahead of the biggest day of earnings this week and some potential market-moving economic reports. The market is very news sensitive regarding trade, so remain flexible as sentiment could quickly shift as this political drama continues.

On the Calendar

On the Thursday Earnings Calendar, we have our biggest day of the week, with 51 companies reporting. Notable reports include ULTA, AOBC, CM, CLDR, DOCU, DG, DLTH, EXPR, GWRE, JILL, KR, MIK, SIG, PLCE, TIF, & ZM.

Action Plan

After the morning pop yesterday, the price action in the indexes stagnated in a sideways chop seemly uncertain as to what comes next. However, this morning, futures have found some inspiration even though the future of the Phase 1 trade deal remains uncertain. With the decline in petroleum reserves and the expectation that OPEC may make deeper cuts in oil production, there was some nice movement in the sector yesterday, helping to the overall market.

Today is the biggest day of earnings this week and could provide the source of inspiration for the bulls or the bears. However, in light of yesterday’s sharp decline in ADP numbers, the Friday Employment Situation report may create more consolidation after the morning rush while we wait. With the market sensitivity to any news on the trade deal and what that might mean for tariffs, traders will have to remain very flexible and prepared for quick price action surges or reversals. As the indexes move back up toward price resistance levels, remember to take some profits.

Trade Wisely,

Doug

Comments are closed.