Although we have had 3-days of pullback in the indexes, the VIX shows little to no fear, and so far the indexes has suffered no discernible technical damage. According to reports, the likelihood of a completed Phase 1 trade deal before the scheduled December 15th tariff increase has diminished. As we head into the uncertainty of the weekend and the coming holiday, it may be difficult for the bulls to find much inspiration. However, a consolidation at this level would be productive and bullish as we wait for some political clarity.

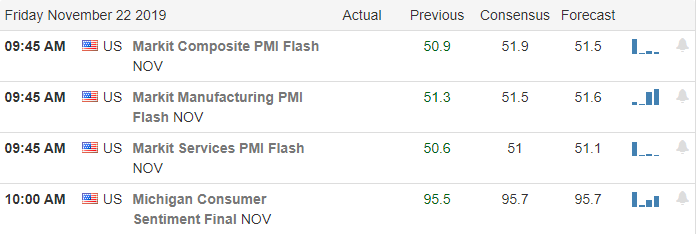

Asian markets closed mixed overnight as trade uncertainty weighed on investor’s minds. Across the pond, European markets are bullish following positive Euro data. US Futures point toward a modestly bullish open ahead of Consumer Sentiment that consensus expects to increase slightly at 10 AM Eastern. Plan your risk carefully as we head into the weekend.

On the Calendar

On the last day of trading this week, we have just 15 companies reporting earnings. Notable reports include BKE, FL, HIBB, and SJM.

Action Plan

During the impeachment hearings, the congress could not be bothered to pass a federal budget but did set aside enough time to kick the can down the road with another stopgap spending bill to avoid a government shutdown. It now looks as if there will not be a Phase 1 trade agreement before the scheduled December 15th tariffs increases. China said in a report that they want a trade deal but are not afraid to fight. Impeachment hearings have not progressed into Russian election meddling as the political drama extends.

With a light day of earnings and economic reports the US Futures are trying to put on a brave face and break the 3-day pullback as we head into the weekend. With not many places to find inspiration and trade up in the air it may be difficult for the bulls to gain much traction. However, if they can prevent additional selling and slip the indexes into a consolidation I believe that would be a win keeping the market trends bullish. Although we pulled back there has been on technical damage, and this rest appears to very constructive thus far. According to the VIX, fear of a selloff remains very low as we head into the weekend.

Trade Wisley,

Doug

Comments are closed.