A sharp end of day rally greatly improved yesterday’s developing candle patterns that had spent most of the day choppy and leaning bearish. However, at the close, the DIA and IWM remain in a bullish consolidation with the SPY leading the pack with a bullish piercing pattern and the QQQ not far behind. It has been an odd earnings season, to say the least, but, thus far the results have provided just enough inspiration to keep in the bears at bay. With a huge day of earnings and economic reports anything is possible, but as of now the bulls have a slight momentum advantage.

Asian markets closed mixed but mostly higher, even as economic growth in South Korea continues to slow. European markets see nothing but green this morning responding to earnings as Brexit uncertainty continues to swirl. US Futures currently indicate a modestly bullish open this morning ahead of a slew of earnings results and several key economic reports.

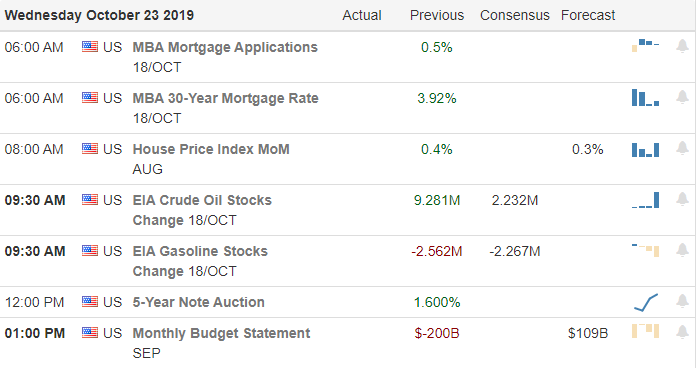

On the Calendar

Today on the Earnings Calendar, we have the biggest day of reports since the 4th quarter reports began. Notable reports include MMM, AB, AMZN, AAL, AEP, AZN, COF, CERN, CINF, CTXS, CMCSA, CUBE, DECK, DOW, FE, FSLR, GILD, GNC, HSY, HBAN, ILMN, INTC, JNPR, KIM, LH, NOK, NOC, ONDK, RTN, RCL, LUV, SWK, TMUS, TROW, TWTR, VLO, VRSN, V, and AUY.

Action Plan

Today this very odd earnings season hits a full stride with more than 250 companies reporting. We can expect significant volatility throughout the day and with big reports after the bell the possibility of a substantial gap Friday morning. Although most of yesterday’s price action was not showing much bullishness an end of day rally as dark pool volume consolidated to the market, it created a late-day rally improving the technical look of the index charts.

The SPY left behind a bullish piercing pattern finishing the day as the strongest chart with the QQQ not far behind. The DIA managed to rally back enough in the last few minutes of the day to remain in a bullish consolidation pattern holding above important supports. If the bulls happen to find inspiration in today’s earnings and economic reports, an attack on all-time highs is possible. Should earnings disappoint, the DIA seems most likely to display the stress and could test it’s 50-day moving average. However, earnings reports have provided just enough positive results that the bulls remain in control so the current momentum although light favors the bulls.

Trade Wisely,

Doug

Comments are closed.