As solid beat by NFLX and early morning news of a draft Brexit deal is making the bulls very happy this morning. The QQQ now looks ready to lead the way and challenge all-time highs in the index. Still ahead is our biggest day of earnings reports this week with a busy morning of Economic reports for the market to digest before the open. Though I’m rooting for the bulls, we have to remember that the bears are unlikely to give up easily. Traders should be careful not to chase morning gaps into resistance highs with the fear of missing out and remember pop and drop pattern can occur in this area.

During the night, Asian markets closed mostly lower as China issued threats of no deal if December tariffs are not removed. However, European markets are green across the board this morning after news of a draft Brexit raises hopes. US Futures also quickly responded higher this morning on the Brexit news pointing to a bullish open ahead of a big day of possible market-moving events.

On the Calendar

On the Thursday Earnings Calendar, we have our biggest day of reports this week, with over 75 companies reporting results. Notable reports include ETFC, BBT, DHR, DOV, EXPO, GPC, HON, ISRG, IVZ, KEY, MTB, MS, PM, SKX, SNA, STI, TSM, & UNP.

Action Plan

After what the UK is calling a last-ditch effort, a new Brexit deal has emerged lifting hopes as October 31 deadline approaches. Now the question to be answered will Parlement ratify the deal? European markets surged higher on news of the draft agreement as did the US Futures. Yesterday the market languished in a sideways chop after a disappointing Retail Sales number that showed even online sales had declined. On the bright side, builder stocks sharply rallied along with building material providers.

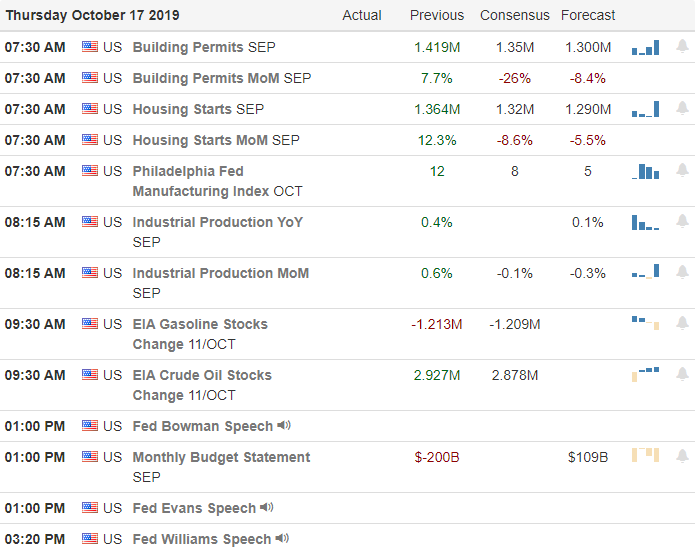

Last night solid earnings beat my NFLX may clear the path for the QQQ to reach out and test record highs in the index even though IBM disappointed investors. With the NASDAQ surging and a possible Brexit deal, the US Futures are suggesting a gap up open ahead of the biggest day of earnings reports this week and a busy Economic Calendar with several possible market-moving reports occurring before the opening bell. That means anything is possible this morning, but as of now the bulls are in control and seem determined to test all-time market highs.

Trade Wisley,

Doug

Comments are closed.