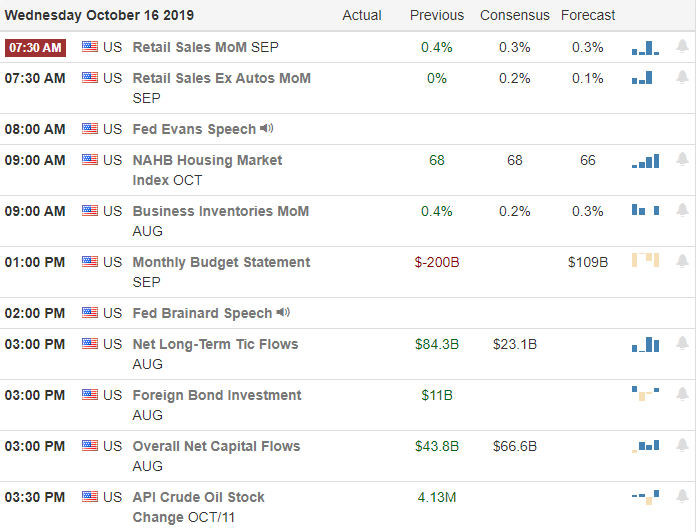

With a solid kickoff to earnings season, JPM and UNH inspired the bulls to test price resistance levels in the indexes. Hopeful reports of a Brexit deal yesterday has now stalled according to reports as the deadline quickly approaches. We have a busy morning of earnings reports and a very important Retail Sales number at 8:30 AM Eastern for the market to digest before the open today. BAC got the ball rolling this morning with an earnings beat, but the futures seem a bit cautious this morning with all the political uncertainty.

Asian market closed trading mixed but mostly higher as hope news of a draft Brexit deal lifted spirits. European markets bounce between negative and positive this morning as they weigh the possible outcomes of Brexit. US Futures traded in the red most of the night, and this morning continues to suggest a modestly lower open ahead of early morning earnings and retail sales reports.

On the Calendar

We have more than 50 companies reporting earnings on the second day of earnings season. Notable reports include IBM, ABT, AA, ALLY, BAC, BK, CCI, CSX, KMI, NFLX, PYPL, PNC, STLD, & USB.

Action Plan

Good earnings reports in JPM, UNH, hopeful Brexit deal news, and tech analysts upgrades lead to a broad-based rally to challenge price resistance in the indexes. After climbing sharply throughout the morning session, upward progress stopped about as suddenly as is began spending the remainder of the day in a narrow range chop zone. This morning we’ve learned that the Brexit negotiations have stalled, BAC had better than expected earnings, and Moody’s declared a high risk of global recession in the next 12 to 18 months.

Ahead of a busy morning of earnings reports and a Retail Sales report, futures point to a modestly lower open at the time of writing this report. I think the big question remains can companies produce earnings to support these high prices during an extended trade war as economies slow around the world? The Big Banks are getting it done, so let’s hope we see that trend continue with big tech reports beginning this afternoon when NFLX and IBM reports. Technically speaking, the bulls are in control with all four major indexes above their 50-averages. However, they remain challenged by downtrend and price resistance levels that have proved tough to breach with so much political uncertainty weighing heavily on the market.

Trade Wisely,

Doug

Comments are closed.