Abounding optimism of a trade deal has the market surging higher this morning even though we have not seen any details as to what negotiations have produced. Will there be a deal, a partial deal or could this morning gap be irrational exuberance? Could this trigger a huge short squeeze that drives short traders of the market, or might this create a big pop and drop pattern if we learn there is no deal and tariffs increase next week? The bigger question is, how will you manage your risk as we head into the weekend if we have no answers to these questions by the close of today?

Overnight Asian markets closed the week green across the board on trade optimism. European markets are also decidedly bullish this morning amid rising hopes of a Brexit deal coming together. US Futures point to a wildly bullish gap up open of more than 250 Dow points as the President, and the Vice-Premier conclude the 2-day meeting today. With such an emotionally charged market, remain flexible and prepare for volatile price action in reaction to trade developments.

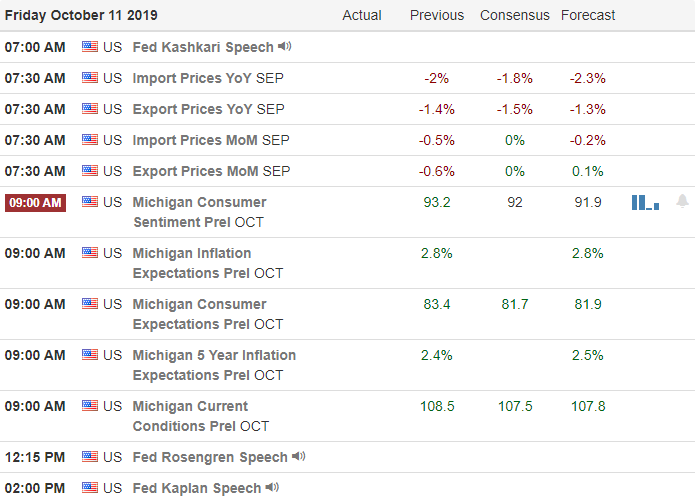

On the Calendar

We have 14 companies expected to report on the Friday Economic Calendar. Notable reports include FAST and INFY before the open today.

Action Plan

Looking at the US Futures this morning, I’m honestly speechless at the huge bullishness this morning after positive comments on negotiations with early today. It seems we’ve been down this road before that ended with no deal, but the market is wildly this morning even though there have been no details released. Perhaps we’ll know more later today but be prepared for potential violent volatility as the news rolls out. There is also hopeful news from across the pond that the British Prime Minister and the EU have found some common ground after reporting a path to a Brexit deal is improving.

Today’s huge gap up could trigger a big short squeeze forcing the market even higher. T2122 could easily swing from short-term oversold to short-term overbought all at once, making a mess of the chart technical. We should also not rule out the possibility of a pop and drop pattern that could quickly develop if the trade news happens to spin the opposite direction. The big question for me is, what happens if we hear no details on trade negotiations until after the market closes? How much risk are you willing to hold into the weekend? Plan carefully and remain focused on price as the emotionally charged market could provide a very wild ride today.

Trade Wisely,

Doug

Comments are closed.