After a punishing selloff, the market will face an expected decline in Factory Orders and the ISM Services Sector report this morning the worry that the global slowdown has expanded into the US economy. Following a win where the WTO agreed with the Whitehouse, the President has scheduled 7.5 billion in European new tariffs on OCT. 18th, opening a new front on the trade war and raising concerns of recession.

Asian markets closed mixed but mostly lower on the ramp-up of trade tensions in Europe. Across the pond, European markets also trade mixed as concerns about how the new tariffs will affect there already weakening economy. Currently, US Futures point to a modestly bullish open ahead of economic reports. Remember we have the Employment Situation report before the open Friday, so plan your risk carefully and don’t be surprised if the price action becomes stale and choppy as we wait.

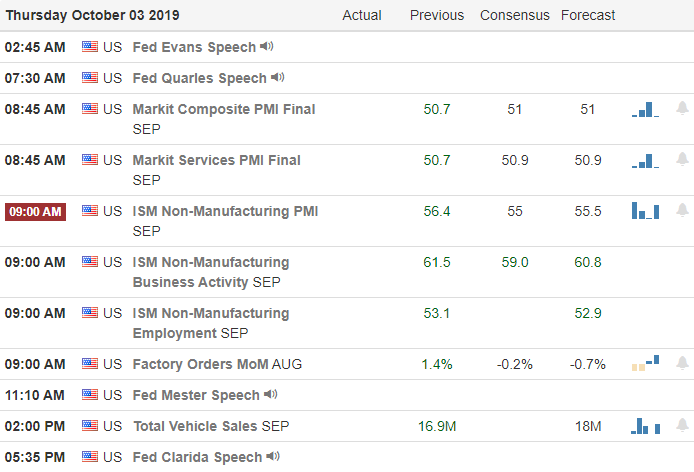

On the Calendar

On the Thursday Earnings Calendar, we have 12 companies reporting results. Notable reports include STZ, COST, and ISCA.

Action Plan

Following an ugly 2-day selloff after a disappointing ISM Manufacturing report, we will get a reading on the service sector with the ISM Non-Mfg report at 10:00 AM eastern along with Factory Orders. The consensus is expecting only a small decline in the services number and an expectation that orders will slip negative that could raise fears of a spreading global slow down. After the World Trade Organization ruled that European government subsidies on aircraft is an unfair trade practice; they cleared the way for the US to impose new tariffs. The President has scheduled 7.5 billion in tariffs to increase on OCT 18th widening the trade tensions and raising concerns of a US recession.

Technically speaking T2122 suggests a short-term oversold condition, but it will be interesting how the market responds to the opening of another trade war front in Europe. After two strong days of selling the Dow continues to hover above its 200-day average as does the QQQ and SPY. Unfortunately, any market relief rally must come under scrutiny as a possible lower high that may confirm the beginning of a market downtrend. Of course, with the Employment Situation number on Friday, 4th quarter earnings just around the corner, and trade talks with China to resume soon traders will have to prepare for just about anything.

Trade Wisely,

Doug

Comments are closed.