An unexpectedly poor manufacturing number quickly reversed early bullishness yesterday creating a nasty whipsaw and leaving behind some worrisome price patterns. The major indexes all dipped below their 50-day averages by the close as they each left behind bearish engulfing patterns in the process. Most troubling was the notable reversals in the financial, transport, and technical sectors. Technical failures in an already uncertain market will likely spark some fear in the market so prepare for higher volatility in the days ahead.

Overnight Asian markets closed in the red across the board in reaction to global slowdown fears. Market in Europe is also looking lower this morning as they wait for the Prime Minister to unveil a revised Brexit proposal for the UK. US Futures have bounced off of overnight lows but still point to substantial gap down this morning and a possible short-term oversold condition according to the T2122 indicator. Expect price action to be volatile, news sensitive and, challenging even for very experienced traders.

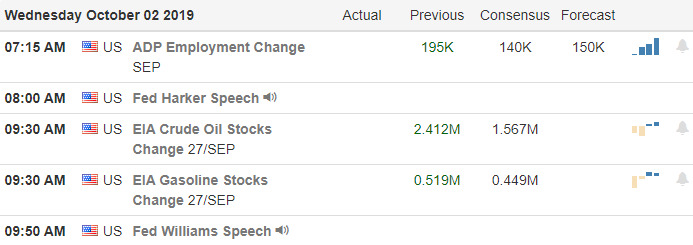

On the Calendar

On the Wednesday Earnings Calendar, we just 12 companies fessing up to quarterly results. Among the notable reports, today are BBBY, LEN, AYI, LW, and PAYX.

Action Plan

On the day after JNJ pays a large fine to settle their roll in the opioid crisis, traders might be looking for something to relieve the pain of yesterday’s selloff and the substantial gap down setting up this morning. By the close on Tuesday all the major indexes slipped below their 50-day moving averages leaving behind some worrisome technical damage in the charts. A surprisingly disappointing manufacturing number created an ugly whipsaw that left bearish engulfing candles all over the place yesterday.

Notable reversals in the financial sector and transports and the technical damage in the tech sector are particularly troubling. At the time of writing this report, US Futures have bounced off of their overnight lows but still suggest a gap down of nearly 150 Dow points at the open. According to the T2122 indicator this will create a short-term oversold condition so be careful not to chase bearish positions already well into their move lower. Remember this is a very emotional news-driven market, so plan your risk carefully and be willing to take profits quickly as they can be very fleeting in this environment.

Trade Wisely,

Doug

Comments are closed.