Yesterday’s whistle-blower hearing brought the buyers to a screeching halt producing another pop and drop pattern. After the hearing, the bulls made a lackluster attempt to rally that was frustratingly choppy as the partisan rhetoric rose to a deafening roar of uncertainty. Traders will have to weigh the risk of the weekend carefully considering that anything is possible by Monday’s open.

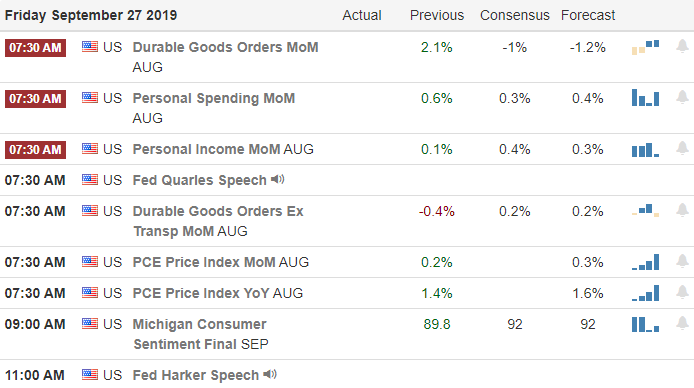

During the night Asia markets closed mixed but mostly lower with trade talks set to resume on Oct. 10th. The markets in Europe are green across the board as trade hopes outweigh the US political turmoil. US Futures point to a modestly bullish open ahead of the Durable Good & Personal Income economic reports. Expect more indecisiveness as we head into the weekend.

On the Calendar

We have just 14 companies expected to report earnings on the Friday calendar. Among those reporting, I’m not seeing any particularly notable reports today.

Action Plan

The frustratingly choppy price action continued yesterday after once again gaping up then finding more sellers than buyers during the whistleblower hearing in Congress. The nonstop barrage of partisan spin is hard to ignore, but it’s imperative that we stay focused on price action to navigate this very difficult market.

After the close yesterday, we learned that US/China trade negotiations would resume on Oct. 10th, only 5-day before the tariffs are scheduled to increase. Let’s hope the talk fast and that the President is correct when he said a deal is closer than most think. We have a light day on the earnings calendar but keep an eye on the Durable Good Orders as well as Personal Income reports at 8:30 AM Eastern. With so much uncertainty as we head into the weekend plan your risk carefully. Literally, anything is possible come Monday’s open!

Trade Wisley,

Doug

Comments are closed.