The mere mention by the President that a deal with China may be closer than everyone thinks and the market rallied shaking of the impeachment drama. More importantly, the SPY bounced off its 50-day average, and the QQQ recovered this key technical support with ease. As bullish as yesterday’s move appears, we must remember that one day does not make a trend and that we still have significant price resistance above for the bulls to overcome.

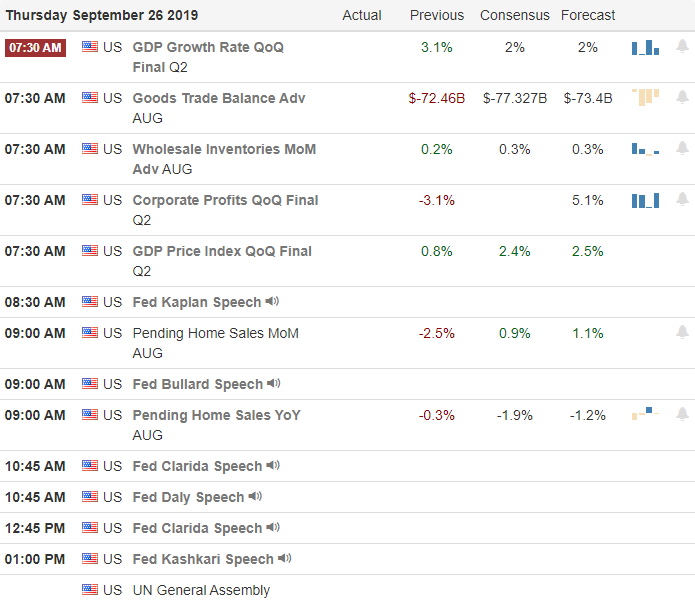

Overnight Asian markets closed mixed but mostly higher on renewed trade hopes, and European see green across the board in response the Presidents comments on a trade deal. US Futures are pushing for a critical follow-through of yesterday’s rally pointing to a modestly bullish as I write this post. With several notable earnings reports ahead as well as a busy morning on the economic calendar anything is possible. Plan carefully and stay focused on the price action for clues as we approach price resistance levels.

On the Calendar

On the Thursday Earnings Calendar we have 21 companies reporting results. Notable reports include CAN, CCL, CAG, FDS, MU, and MTN.

Action Plan

The market shook off the impeachment inquiry yesterday after the President mentioned a deal with China might come sooner than everyone expects. Technically speaking yesterday’s rally was a substantial win for the bulls with the SPY bouncing off its 50-day average and the QQQ easily recovery this key psychological level. Now it’s important that we see some followthrough bullishness or yesterday’s move looks more like a dead cat bounce within an existing downtrend.

A one day rally does not make a trend, but I must admit it does raise hopefulness of better days ahead assuming it can hold. Another thing the market could be betting on is that the impeachment process will bring Congress to a halt. A gridlocked government is often seen as bullish by the market. The impeachment of President Clinton kept the Congress busy for about 18 months, and during that time the market experienced a substantial rally. Will history repeat? Only time will tell so turn off the distracting political drama news and stay focused on the price action of the charts.

Trade Wisely,

Doug

Comments are closed.