The bulls did a good job defending yesterday’s modest gap down open setting the stage for another possible attack of all-time highs. With several notable earnings reports today and a reading on Consumer Confidence the bulls may find the inspiration needed breakthrough the 3000 SPY resistance that has proven so difficult to hold.

Asian markets closed modestly green across the board as trade uncertainty, and global growth concerns grow. A day after disappointing German economic numbers European markets are flat to slightly bullish this morning. US Futures appear confidently bullish this morning suggesting a nearly 100 point gap up to challenge resistance levels once again. Consider your risk carefully and avoid chasing gap up entries at or near price resistance levels.

On the Calendar

On the Tuesday Earnings Calendar we have 28 companies fessing up to quarterly results. Notable earnings include NKE, NIO, AZO, BB, KMX, CTAS, INFO, JBL and MANU.

Action Plan

Yesterday’s light and chopping price action saw the bulls working to defend the lows of the morning gap down. Index futures held positive throughout the night, suggesting a bullish open and perhaps another attempt by the bulls to attack the all-time market highs. The DIA will first have to deal with the price resistance around 271, and the SPY will have to breach the resistance at 300. The QQQ’s have a considerable amount of work to do before breaking out, but it is bullish that thus far the bulls have successfully defended its 50-day average as support.

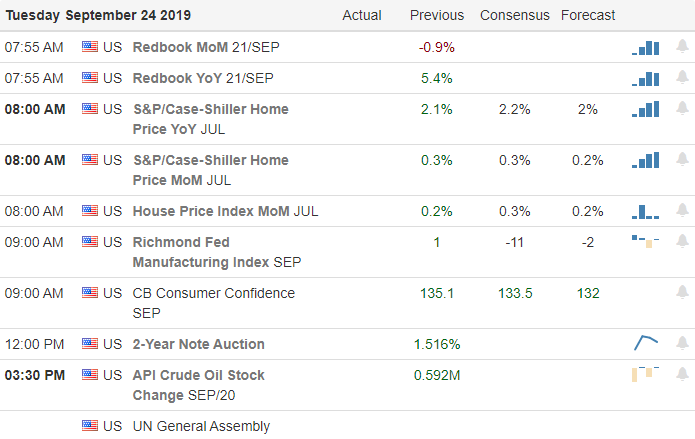

A little concerning is that we had safe-haven plays such as Gold, Silver, defensive sector stocks and even utilities were going up yesterday with the overall market. Oil stocks continue to recover after the Saudi oil field attack and yesterday saw a strong push in retail with stocks like DLTR, TGT, and WMT rising. Currently, futures point to a bullish open ahead of the Case-Shiller, and Consumer Confidence reports as well as several notable earnings. With trade talks scheduled to resume in a couple of weeks and new tariffs increases scheduled for the 15th of October, markets will continue to be news sensitive in the days and weeks ahead.

Trade Wisely,

Doug

Comments are closed.