I guess at this point we should not be surprised to see yet another overnight reversal and once again confirming traders cannot trust price the price action from one day to the next. After the market closed yesterday we learned that Parliament voted to take control of the government and will today attempt a vote to block a no-deal Brexit attempt by the Prime Minister. We also learned that Hong Kong has finally withdrawn the China extradition bill that sparked so much public unrest.

Asian markets closed higher across the board last night with the HSI zooming up 995 points after the withdraw of extradition bill. European market sees green across the board, and the Sterling has recovered after the UK Parlement vote blocking the Prime Ministers no-deal Brexit plans. Consequently, US Futures point to a gap up with the Dow currently expected to open about 200 points higher ahead of earnings and a full of FOMC speakers.

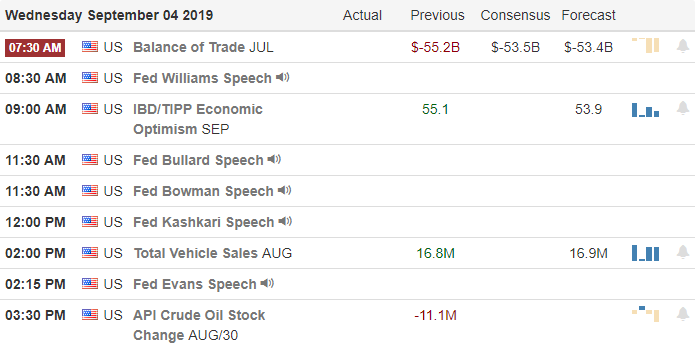

On the Calendar

On the hump day Earnings Calendar, we have 26 companies reporting quarterly results. Some of the notable reports include WORK, AVAV, AEO, HOME, CLDR, MIK, PANW & VRA.

Action Plan

Tuesday morning brought out the sellers after manufacturing numbers declined, but the bulls found some inspiration recovering slowly but steadily throughout the afternoon. Tensions are high today in the UK after a majority voted to take control of Parliament. The action blocked the Prime Ministers plans to suspend Parliament forcing a no-deal Brexit. Later today Parliament will vote in an attempt to block the Boris Johnson no-deal plans scheduled for October 31. We could see US market volatility as a result. Hong Kong markets experienced a huge rally during the night when leader Carrie Lam announced the withdraw of the conversational extradition bill.

As a result of all the overnight news, US Futures point to a bullish open ahead of earnings reports and the International Trade numbers set for 8:30 AM Eastern release. Consensus estimates suggest a decline in the trade deficit in July. We also a full day of Fed Speakers between 9:30 AM and 3:15 PM with a total five FOMC members on the calendar. All in all just another day of market turmoil with yet another overnight reversal gap making price action nearly impossible to trust from day-to-day.

Trade Wisely,

Doug

Comments are closed.