Although the overnight reversal was a welcome relief from Friday’s selloff there remains a lingering uncertainty that there will progress made on trade negotiations. We have been here before with high hopes only to see the negotiations breakup in a matter of hours. Fool me once shame on you, fool me twice shame on me seems to be the attitude of the market. It’s time to see some actual progress rather than platitudes and political spin. Expect price volatility to continue as the indexes continue to deal with significant technical damage.

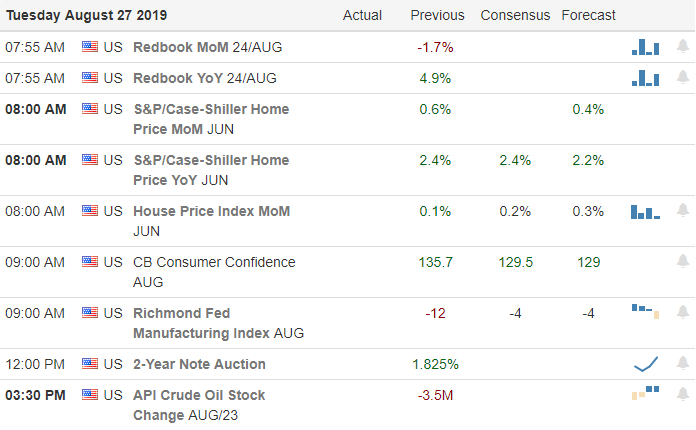

Overnight Asian markets closed mixed but mostly positive, and traders moved tentatively watching trade developments with caution. This morning European markets trade cautiously mixed as well this morning as the world waits for some clarity. US Futures have recovered from early losses pointing to a relatively flat open ahead of earnings and Consumer Confidence reports.

On the Calendar

On the Tuesday Earnings Calendar, we have just 37 companies reporting results. Notable earnings reports today include ADSK, BMO, BNS, BNED, EV, FRO, HPE, SJM, and VEEV.

Action Plan

Yesterday’s relief rally on hopes of US and China re-engaging in negotiations was very nice but technically speaking very little changed. While it’s encouraging that the indexes held Friday’s lows as support the overall downtrend of the indexes remains intact with significant price and moving-average resistance above. While the President talks favorably about China’s desire to make a deal, there is a palpable uncertainty by the market.

That uncertainty is justified because we have been here before only to be disappointed with negotiations attempts breaking up just hours after restarting last time. That appears to be making the US Futures a bit tentative this morning pointing to a flat open. Expect volatile price action to continue as the market continues to hope for but still waits for clarity.

Trade Wisley,

Doug

Comments are closed.