FOMC Chairman Jerome Powell’s tightrope walk begins at 10:00 AM Eastern from the Jackson Hole economic policy symposium. The entire financial world will be watching hoping to gain some clarity as to the committee’s future rate plans. If the market perceives dovishness, we could end this choppy week with a nice rally. Hints of hawkishness and can expect the very sensitive bonds to react negatively and emboldening the bears triggering an attack. No matter what you want, the Fed to do, it would be wise to remain flexible and stay focused on the price action likely to become volatile.

Asian markets finished up their week positively even as tensions grow between Japan and South Korea and the Yuan dipped to new lows. European indexes are cautiously higher this morning as they wait for Powell’s address. As a result, US Futures have held positive all night long indicating a modestly bullish open with the hopefulness of a dovish FOMC. How today ends up is anyone guesses but consider your risk carefully as we head into the weekend.

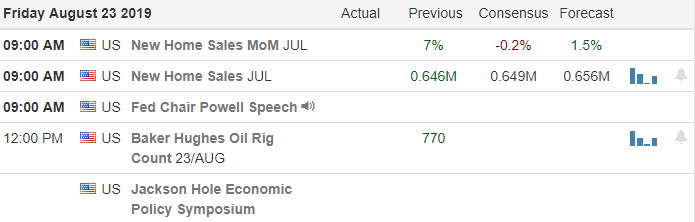

On the Calendar

On the Earnings Calendar, we get a little break with only 28 companies reporting this Friday. Among the notables are FL, and BKE.

Action Plan

Today the market with turn all of its attention to Jackson Hole and the Chairman Powell’s address at 10:00 AM Eastern. The market is seeking clarity of FOMC’s plans for rate cuts later this month and into the future. If his speech comes off with a dovish tone, the market will likely react quickly with a bullish move to end a week of otherwise choppy and frustrating price action. However it there is even a hint of hawkishness in his speech the bears could quickly attack, and bond yields could once again invert. Indeed a difficult tightrope to walk for the chairman as the entire financial world watches.

Yesterday the market chopped in lockstep with the bond rates. Early in yesterday session bond yields inverted but later recovered as did the market. This morning there is a slight improvement in yields with the hopefulness of an FOMC action. The indexes are still facing the challenge of overhead price resistance and their respective 50-day moving averages. Prepare for volatility as Powell speaks and consider your risk carefully as we head into the uncertainty of the weekend.

Trade Wisley,

Doug

Comments are closed.