Lots of questions with very few answers created a very frustrating day of price action on Thursday. As bond yields finally began to moderate late afternoon, the market picked a direction and provided a least a modest relief rally into the close. A good round of earnings reports after the bell and a bit of bond market stabilization during the night lifted spirits around the world. The big question for traders this morning, can we trust this mornings bullishness amidst all the volatility enough to add risk heading into the weekend still full of uncertainty?

Overnight Asian market closed modestly bullish across the board as bond yield slightly improved. European markets are moving higher this morning after a technical issue delayed the open in the UK. US Futures are solidly bullish this morning with the Dow pointing to a gap up of more than 200 points. Be careful not to chase the open in-case this wildly volatile decides to pop and drop. Also, consider carefully the amount of risk your willing to carry into the weekend.

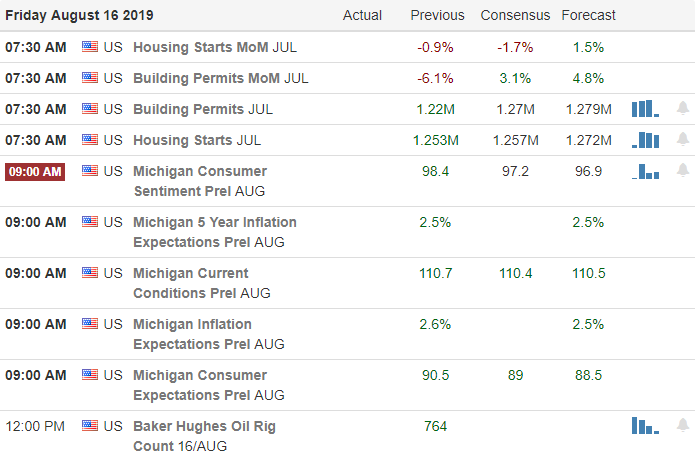

On the Calendar

We get a little break on the Friday Earnings Calendar with just 68 companies reporting earnings today with DE as the most notable.

Action Plan

Will, there be real progress on trade negotiations or not? Will the FOMC reduce the rates or not? Will, the Bond Rates, invert and remain inverted or not? Will China send troops into Hong Kong to put down the protests or not? Will the global economic slow down effect the US economy or not? That uncertainty created another very volatile session on Thursday, and until we get some clarity is likely to continue to create very difficult price action for traders to navigate.

Yesterday T2122 signaled an oversold condition, but with so much uncertainty the market struggled until late afternoon when it finally managed to put together a little relief rally. A round of good earnings reports after the bell also lifted spirits, and treasury yields somewhat stabilizing during the night has futures pointing to a significant gap up this Friday morning. The question is, can we trust it, or could it produce a pop and drop pattern or even worse another lower high within the downtrend? Secondly, how much risk will traders be willing to hold into an uncertain weekend? Nonetheless, any relief rally is a welcome sight after a week of heavy selling.

Trade Wisely,

Doug

Comments are closed.