Friday’s price action certainly raised a lot of concerns, but the selling stopped short of breaking the current up-trends in the DIA, SPY, and QQQ leaving behind a palpable earnings uncertainty. Of course, the growing tensions with Iran and the uncertainty of US/China trade negotiations and huge earnings calendar this week only add to the uncertain path ahead. We should expect and prepare for the possibility that two-sided very challenging price action will continue in the days ahead.

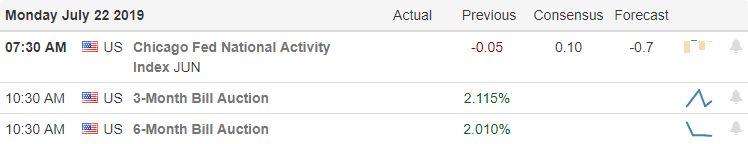

Asian markets struggled overnight closing in the red across the board. However, European markets are currently trading with modest gains across its 3-major indexes this morning. US Futures are also projecting modest gains at the open as earnings continue to roll out. There is little on the Economic Calendar for the market to react on this morning, so it’s all about the quality of the earnings reports and how they are perceived by the market this morning. With so many big reports this week we should plan for the possibility of large overnight gaps and reversals and should plan our risk accordingly.

On the Calendar

On the Monday Earnings Calendar, we have 70 companies reporting in a week where the number of earnings ramp up substantially. Among the notable are ACC, CALM, GNC, HAL, LII, PETS, STLD, AMTD, WHR, and ZION.

Action Plan

No doubt about it last Friday was a rough day as selling increased into the close as traders took profits ahead of an uncertain weekend. Tensions with Iran continued to grow after Friday’s capture of a British oil tanker and now the claims they have claimed they have captured and detained about a dozen individuals they accuse as US spies. However, the Friday selling stopped short of breaking the current uptrends in the DIA, SPY, and QQQ. Although the price patterns left behind warrant an extra measure of caution keep in mind, there must be a downside follow-through breaking trends to indicate bearishness.

This morning futures are currently pointing to bullish open ahead of the 70 or so earnings reports expected today. We should expect the rather challenging volatility to continue and the possibility it could ramp up with about 800 earnings reports, including three-quarters of the so-called FANG companies. Large overnight gaps are possible as these big techs report so carefully plan your risk. So far, the earings price action has been very choppy and two-sided, so it may be wise to avoid becoming over-extended in your holding with a single directional bias.

Trade Wisely,

Doug

Comments are closed.